As we navigate the complex landscape of pensions and retirement planning, a revolutionary solution emerges for Bitcoin enthusiasts – the Bitcoin Tontine. Imagine a retirement option that combines the potential of Bitcoin returns with the security of a lifetime income. Sounds intriguing, right?

Exploring the Concept of Tontines

Understanding Tontines: A Unique Approach to Retirement Income

Let's break it down. A Tontine operates by pooling the longevity risk of participants, ensuring a steady income stream for life. Each member contributes to a segregated trust, with payouts tied to the collective lifespan of the group. When a member passes away, the remaining funds are redistributed among the group, enhancing retirement income over time.

Factors like life expectancy, investment fund value, and expected returns influence the income payouts. This dynamic system guarantees a lifelong income while adapting to changing circumstances, offering financial security without the fear of running out of funds.

Comparing Tontines to Annuities

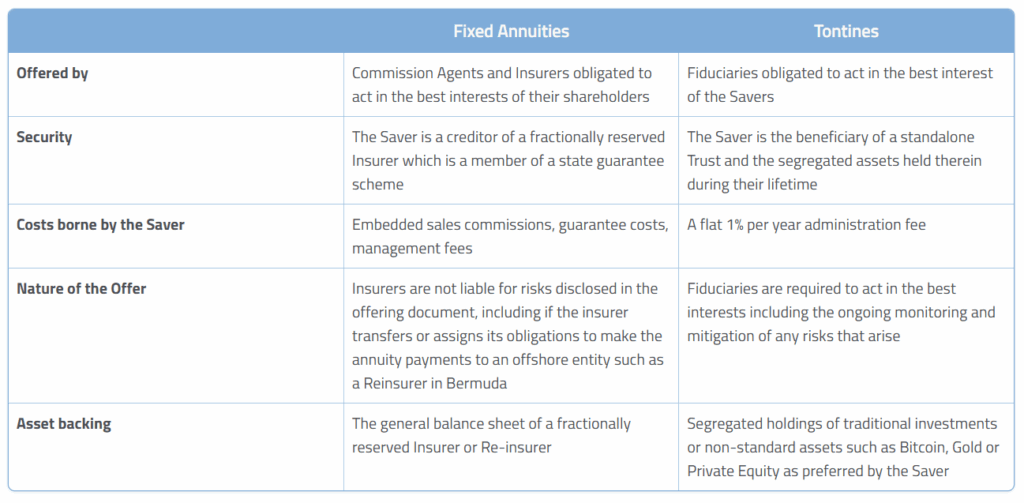

Unlike traditional annuities, Tontines offer transparency and flexibility in investment choices. With diverse asset classes and the ability to adjust strategies, Tontines provide higher potential returns throughout retirement. While annuities promise fixed incomes, Tontines leverage Bitcoin returns and investment diversity to optimize payouts, albeit with some fluctuations.

By embracing the Tontine model, participants stand to benefit from increased income stability and growth potential compared to conventional annuities.

Potential Challenges and Solutions

Addressing Tontine Concerns

One key challenge with Tontines lies in fraud prevention and member longevity impact on payouts. To combat this, Tontine Trust introduces innovative proof of life measures through blockchain technology, ensuring fair and secure income distribution. By maintaining strict accounting practices and transparency, Tontines mitigate risks associated with longevity and fraud.

Regulatory Landscape and Future Prospects

Recent developments signal a shift towards embracing Tontines as a retirement solution. With organizations like the OECD advocating for longevity risk protection and government initiatives promoting alternative assets, Tontines, particularly Bitcoin-backed ones, are gaining recognition as a viable option for retirement planning.

Looking ahead, the concept of National Tontines supported by Bitcoin could redefine social security, offering inflation-proof income and intergenerational fairness. As demographics evolve, innovative solutions like Tontines present a compelling alternative to traditional pension models.

The Future of Retirement Planning

As we approach the 17th anniversary of the Bitcoin whitepaper, the emergence of the Bitcoin Tontine signifies a groundbreaking approach to retirement security. With the promise of enhanced returns and lifelong income guarantees, the Bitcoin Tontine stands out as a progressive choice for those seeking financial stability in retirement.

Embrace the future of retirement planning with the Bitcoin Tontine – where transparency, Bitcoin returns, and lifelong income converge to shape a secure financial future.

Frequently Asked Questions

Can I buy gold with my self-directed IRA?

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

Individuals can contribute as much as $5,500 per year ($6,500 if married filing jointly) to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contracts are financial instruments based on the price of gold. They allow you to speculate on future prices without owning the metal itself. You can only hold physical bullion, which is real silver and gold bars.

Can the government seize your gold?

You own your gold and therefore the government cannot seize it. It's yours, and you earned it by working hard. It belongs entirely to you. However, there may be some exceptions to this rule. You can lose your gold if you have been convicted for fraud against the federal governments. Also, if you owe taxes to the IRS, you can lose your precious metals. You can keep your gold even if your taxes are not paid.

What tax is gold subject in an IRA

The fair value of gold sold to determines the price at which tax is due. When you purchase gold, you don't have to pay any taxes. It isn't considered income. If you sell it later, you'll have a taxable gain if the price goes up.

For loans, gold can be used to collateral. Lenders look for the highest return when you borrow against assets. For gold, this means selling it. The lender might not do this. They may just keep it. They might decide to sell it. Either way you will lose potential profit.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. Otherwise, it's better to leave it alone.

What are the fees associated with an IRA for gold?

$6 per month is the Individual Retirement Account Fee (IRA). This includes the account maintenance fees and any investment costs associated with your chosen investments.

You may have to pay additional fees if you want to diversify your portfolio. The type of IRA you choose will determine the fees. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

Most providers also charge an annual management fee. These fees can range from 0% up to 1%. The average rate per year is.25%. These rates can often be waived if a broker, such as TD Ameritrade, is involved.

Is gold a good choice for an investment IRA?

If you are looking for a way to save money, gold is a great investment. It can be used to diversify your portfolio. But there is more to gold than meets the eye.

It has been used throughout history as currency and it is still a very popular method of payment. It is sometimes called the “oldest currency in the world”.

But gold, unlike paper currency, which is created by governments, is mined out from the ground. That makes it very valuable because it's rare and hard to create.

Gold prices fluctuate based on demand and supply. When the economy is strong, people tend to spend more money, which means fewer people mine gold. As a result, the value of gold goes up.

On the flipside, people may save cash rather than spend it when the economy slows. This results in more gold being produced, which drives down its value.

This is why gold investment makes sense for both individuals and businesses. If you make an investment in gold, you can reap the economic benefits whenever the economy is growing.

Your investments will also generate interest, which can help you increase your wealth. Plus, you won't lose money if the value of gold drops.

How much should precious metals be included in your portfolio?

This question can only be answered if we first know what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them valuable in investment and trading. Gold is by far the most common precious metal traded today.

But, there are other types of precious metals available, including platinum and silver. The price of gold fluctuates, but it generally remains stable during times of economic turmoil. It is also unaffected significantly by inflation and Deflation.

The general trend is for precious metals to increase in price with the overall market. But they don't always move in tandem with one another. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. This is because investors expect lower interest rates, making bonds less attractive investments.

However, when an economy is strong, the reverse effect occurs. Investors favor safe assets like Treasury Bonds, and less precious metals. They are more rare, so they become more expensive and less valuable.

Therefore, to maximize profits from investing in precious metals, you must diversify across multiple precious metals. It is also a good idea to diversify your investments in precious metals, as prices tend to fluctuate.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement plans

cftc.gov

forbes.com

How To

The best way online to buy gold or silver

To buy gold, you must first understand how it works. Precious metals like gold are similar to platinum. It's very rare, and it is often used as money for its durability and resistance. It's difficult to use, so most people prefer purchasing jewelry made from it rather than actual bars.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coin are not intended for investment. However, their value will increase with inflation.

They aren't circulated in any currency exchange systems. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. For every dollar spent, the buyer gets 1 gram of Gold.

The next thing you should know when looking to buy gold is where to do it from. There are several options available if your goal is to purchase gold from a dealer. First off, you can go through your local coin shop. You can also go to a reputable website such as eBay. You might also consider buying gold from an online private seller.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. When selling gold through private sellers, you pay a commission fee of 10% to 15% per transaction. This means that you will get less back from a private seller than if you sell it through a coin shop or on eBay. This option is often a great choice for investing gold as it allows you more control over its price.

The other option is to purchase physical gold. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

A bank or pawnshop can help you buy gold. A bank can offer you a loan for the amount that you need to buy gold. Customers can borrow money from pawnshops to purchase items. Banks charge higher interest rates than those offered by pawn shops.

You can also ask for help to purchase gold. Selling gold is also easy. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————–

By: Bitcoinactuary

Title: The Bitcoin Tontine: Securing Your Retirement with Transparency and Bitcoin Returns

Sourced From: bitcoinmagazine.com/markets/the-return-of-the-tontine-a-natural-retirement-option-for-bitcoiners

Published Date: Mon, 17 Nov 2025 13:30:00 +0000