As we ride the waves of the current bitcoin bull market, it's crucial to shift our focus from the sky-high possibilities to the grounded realities ahead. Let's dive into the numbers and formulas that offer insights into where Bitcoin's price floor might lie in the future, not as a crystal ball prediction, but as a well-informed framework based on past trends, on-chain metrics, and the core values of BTC.

Decoding Bitcoin's Past: Insights from Historical Price Bottoms

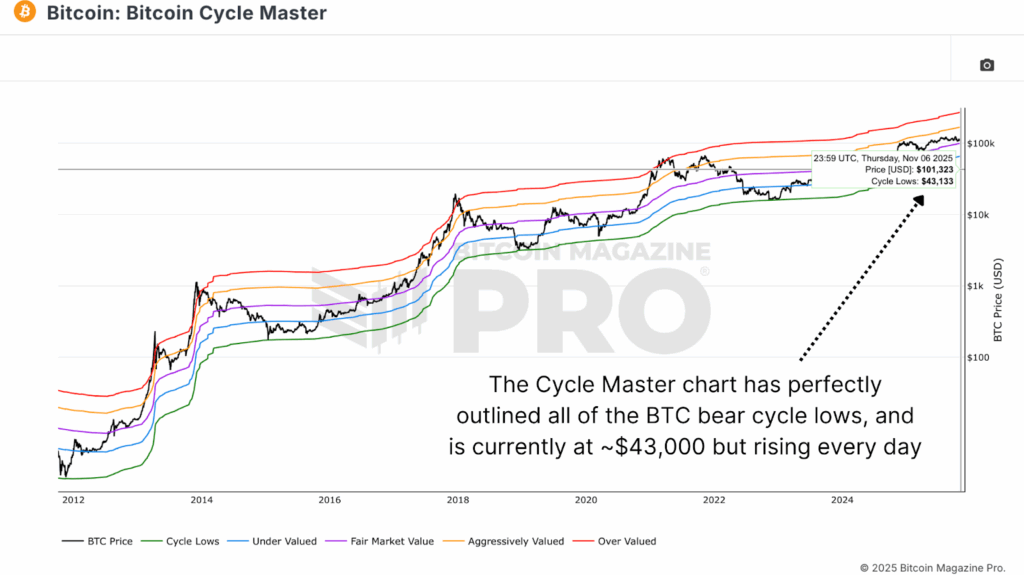

Picture this: identifying Bitcoin's cyclical lows is akin to following a treasure map, and one of the most reliable maps out there is the Bitcoin Cycle Master chart. This chart, fueled by various on-chain metrics, has consistently highlighted key price levels that mark major bottoms for Bitcoin.

Unlocking the Cycle Master Chart:

- It accurately pinpointed lows at $160 in 2015, $3,200 in 2018, and $15,500 in late 2022.

- Currently, the baseline sits around $43,000 and is on the rise, giving us a reference point for potential future declines.

The Evolution of Bitcoin Bear Markets: Understanding Diminishing Drawdowns

Now, let's dive deeper into the raw MVRV Ratio, a metric that reveals how Bitcoin's market price relates to its actual cost basis. During severe bear markets, Bitcoin has historically dropped to around 0.75x its realized price, indicating a 25% deviation from the network's average cost.

This consistent pattern, combined with the trend of diminishing drawdowns, provides a solid foundation for estimating potential downturns. While Bitcoin once saw massive 88% declines, recent years have shown a decrease to 75%, suggesting that future bear markets might bring around a 70% retracement from peak prices.

Peering into the Future: Predictions for Bitcoin's Next Price Swings

Before we set our sights on the next low, let's first project where this bullish ride might peak. By analyzing historical data and growth trends, Bitcoin has tended to hit a top around 2.5x its realized price. If this trend holds, we could see Bitcoin hitting approximately $180,000 per BTC in late 2025.

What's Next?

- If history repeats itself, and Bitcoin experiences a 70% retracement post-peak, we might witness a price range of $55,000–$60,000 by 2027, aligning with past consolidation levels.

Bitcoin's Value Equation: Production Costs and Price Dynamics

Another key factor in Bitcoin's valuation is its production cost, reflecting the energy expenses required to mine one BTC. This cost has historically acted as a solid support level during bear markets, doubling after each halving event and influencing price floors.

When Bitcoin falls below its production cost, it signals opportunities for accumulation and often marks significant price reversals. Currently hovering around ~$70,000, this cost basis plays a crucial role in determining market dynamics.

What Lies Ahead: A Glimpse into Bitcoin's Future Cycles

With each Bitcoin cycle, we hear echoes of "This time is different," yet the data sings a familiar tune. Institutional shifts and financial integrations have reshaped Bitcoin, but its cyclicality remains intact.

The forecast hints at a milder bear market, reflecting a more mature market driven by liquidity. A pullback towards the $55,000–$70,000 range signifies a phase of recalibration rather than collapse, maintaining Bitcoin's historical rhythm of growth and correction.

Frequently Asked Questions

Which precious metal is best to invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Although gold has been considered a safe investment, it is not always the most lucrative. You might not want to invest in gold if you're looking for quick returns. If patience and time are your priorities, silver is the best investment.

If you don’t desire to become rich quickly, gold may be your best option. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

How to Open a Precious Metal IRA?

The first step is to decide if you want an Individual Retirement Account (IRA). Once you have decided to open an Individual Retirement Account (IRA), you will need to complete Form 806. To determine which type of IRA you qualify for, you will need to fill out Form 5204. You must complete this form within 60 days of opening your account. Once you have completed this form, it is possible to begin investing. You might also be able to contribute directly from the paycheck through payroll deduction.

If you opt for a Roth IRA, you must complete Form 8903. Otherwise, the process is identical to an ordinary IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. You can't earn more than $110,000 per annum ($220,000 in married filing jointly) for any given tax year. Additionally, you must make regular contributions. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

An IRA for precious metals allows you to invest in gold and silver as well as platinum, rhodium, and even platinum. However, you won't be able purchase physical bullion. You won't have the ability to trade stocks or bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. This option is available from some IRA providers.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they're not as liquid as stocks or bonds. It's also more difficult to sell them when they are needed. They also don't pay dividends, like stocks and bonds. Therefore, you will lose more money than you gain over time.

How can I withdraw from a Precious metal IRA?

First decide if your IRA account allows you to withdraw funds. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. If you decide to go with this option, you will need to take into account the taxes due on the amount you withdraw.

Next, calculate how much money your IRA will allow you to withdraw. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you determine the percentage of your total saved money you want to convert into cash, then you need to choose which type IRA you will use. Traditional IRAs allow you to withdraw funds tax-free when you turn 59 1/2 while Roth IRAs charge income taxes upfront but let you access those earnings later without paying additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

When you do finally decide to withdraw from your precious metallic IRA, you will need a safe space where you can safely store your coins. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. You will need to weigh each one before making a decision.

Bullion bars require less space, as they don't contain individual coins. But you will have to count each coin separately. On the flip side, storing individual coins allows you to easily track their value.

Some people prefer to keep coins safe in a vault. Others prefer to place them in safe deposit boxes. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

Can I hold a gold ETF in a Roth IRA?

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

Traditional IRAs allow for contributions from both employees and employers. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

Also available is an Individual Retirement Annuity. An IRA allows for you to make regular income payments during your life. Contributions to IRAs will not be taxed

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

Investing in gold or stocks

Investing in gold as an investment vehicle might seem like a very risky proposition these days. This is because many people believe that gold investment is no longer profitable. This belief comes from the fact most people see gold prices falling due to the global economy. They fear that investing in gold will result in a loss of money. In reality, however, there are still significant benefits that you can get when investing in gold. Here are some examples.

Gold is one of the oldest forms of currency known to man. There are records of its use going back thousands of years. It has been used as a store for value by people all over the globe. It's still used by countries like South Africa as a method of payment.

Consider the price per gram when you decide whether you should invest in or not. If you're interested in buying gold bullion, it is crucial that you decide how much per gram. If you don’t know what the current market price is, you can always call a local jewelry store and ask them their opinion.

It's worth noting, however, that while gold prices have fallen recently the cost of producing gold is on the rise. So, although gold prices have declined in recent years, the cost of producing it has not changed.

The amount of gold that you are planning to purchase is another important consideration when deciding whether or not gold should be bought. For example, if you only intend to purchase enough to cover your wedding rings, it probably makes sense to hold off on buying any gold. It is worth considering if you intend to use it for long-term investment. If you sell your gold for more than you paid, you can make a profit.

We hope this article helped you to gain a better appreciation of gold as a tool for investment. Before making any investment decisions, we strongly advise that you thoroughly research all options. Only then will you be able to make an informed decision.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Predicting Bitcoin's Future: A Data-Driven Analysis

Sourced From: bitcoinmagazine.com/markets/predicting-bitcoin-price-floor

Published Date: Fri, 07 Nov 2025 21:50:58 +0000