Hey there, crypto enthusiasts! Curious about where Bitcoin's price is headed? Let's dive into the latest insights and projections to keep you in the loop. Bitcoin's recent price movements and upcoming events could pave the way for a significant surge, possibly reaching $130,000. Exciting, right?

Bitcoin's Price Momentum

Current Support and Resistance Levels

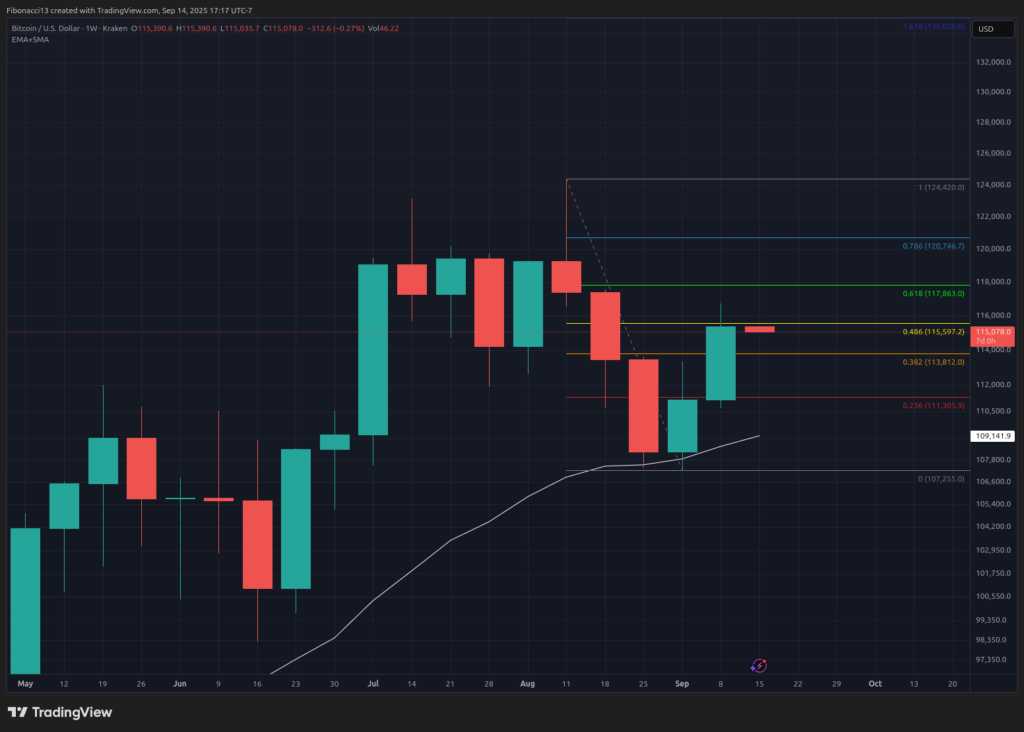

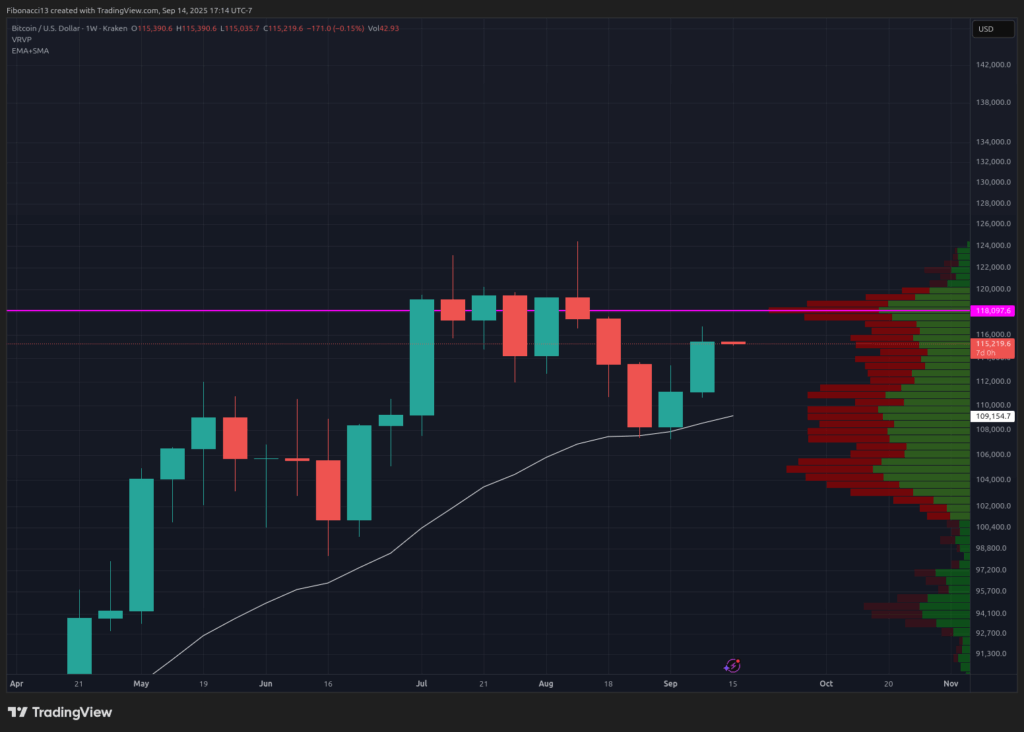

As Bitcoin hovers around the $115,500 mark, the next resistance lies at $118,000. However, a strong push might see it breach $118,000 momentarily, only to face resistance again. On the downside, short-term support is expected around $113,800, with a more robust support zone near $111,000.

Forecast for the Week

While Bitcoin's bias appears slightly bearish, positive stock market trends could swiftly turn the tide. Technical indicators like the MACD and RSI suggest a potential bullish return. All eyes are on the Federal Reserve's upcoming decision, as any surprises could trigger market volatility.

Market sentiment: Bullish, with a focus on testing the $118,000 level this week after two consecutive weeks of gains.

Looking Ahead

Securing ground above $118,000 in the near future is crucial for Bitcoin's upward trajectory. A successful consolidation at this level could propel Bitcoin towards the $130,000 mark. Market data and continued rate cuts will play a pivotal role in sustaining this bullish momentum.

However, adverse events or unexpected Fed decisions could lead to a retracement towards support levels.

Cryptocurrency Jargon Explained

Bulls/Bullish: Investors anticipating rising prices.

Bears/Bearish: Investors expecting price declines.

Support/Resistance Levels: Price levels where assets tend to hold or face rejection.

SMA: Simple Moving Average, an average price over a specific period.

Oscillators: Indicators like RSI and MACD that signal overbought or oversold conditions.

Exciting times ahead for Bitcoin! Stay tuned for more updates and happy investing!

Frequently Asked Questions

Can the government steal your gold?

Your gold is yours and the government cannot take it. It is yours because you worked hard for it. It belongs entirely to you. This rule could be broken by exceptions. Your gold could be taken away if your crime was fraud against federal government. Also, if you owe taxes to the IRS, you can lose your precious metals. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

Is gold a good IRA investment?

Any person looking to save money is well-served by gold. It's also a great way to diversify your portfolio. But gold has more to it than meets the eyes.

It's been used throughout history as a currency, and even today, it remains a popular form of payment. It's sometimes called “the world's oldest money”.

But unlike paper currencies, which governments create, gold is mined out of the earth. This makes it highly valuable as it is hard and rare to produce.

The supply-demand relationship determines the gold price. When the economy is strong, people tend to spend more money, which means fewer people mine gold. This results in gold prices rising.

On the other hand, people will save cash when the economy slows and not spend it. This means that more gold is produced, which reduces its value.

This is why both individuals as well as businesses can benefit from investing in gold. You'll reap the benefits of investing in gold when the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. You won't lose your money if gold prices drop.

How much money should I put into my Roth IRA?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. These accounts cannot be withdrawn until you turn 59 1/2. If you decide to withdraw some of your contributions, you will need to follow certain rules. First, you can't touch your principal (the initial amount that was deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you decide to withdraw more money than what you contributed initially, you will need to pay taxes.

The second rule is that your earnings cannot be withheld without income tax. You will pay income taxes when you withdraw your earnings. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let's say you earn $10,000 each year after contributing. On the earnings, you would be responsible for $3,500 federal income taxes. You would have $6,500 less. The amount you can withdraw is limited to the original contribution.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. On top of that, you'd lose half of the earnings you had taken out because they would be taxed again at 50% (half of 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

There are two types of Roth IRAs: Traditional and Roth. A traditional IRA allows for you to deduct pretax contributions of your taxable income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. A traditional IRA can be withdrawn up to the maximum amount allowed.

Roth IRAs won't let you deduct your contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. There is no minimum withdrawal required, unlike a traditional IRA. You don't have to wait until you turn 70 1/2 years old before withdrawing your contribution.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement plans

cftc.gov

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Do you want to keep your IRA gold at home? It's Not Exactly Lawful – WSJ

How To

Gold IRAs: A Growing Trend

The gold IRA trend is growing as investors seek ways to diversify their portfolios while protecting against inflation and other risks.

Owners can invest in gold bars and bullion with the gold IRA. It is tax-free and can be used by investors who aren't concerned about stocks and bond.

Investors can have confidence in their investments and avoid market volatility with a gold IRA. The gold IRA can be used to protect against inflation or other potential problems.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

The gold IRA also offers many other benefits, such as the ability to quickly transfer the ownership of the gold to heirs, and the fact the IRS doesn't consider gold a currency.

Investors looking for financial security are increasingly turning to the gold IRA.

—————————————————————————————————————————————————————————————–

By: Ethan Greene – Feral Analysis

Title: Bitcoin Price Analysis: Potential Surge to $130,000 with Federal Reserve's Policy Signal

Sourced From: bitcoinmagazine.com/markets/bitcoin-eyes-130000-if-fed-signals-dovish-policy

Published Date: Mon, 15 Sep 2025 20:56:26 +0000

Did you miss our previous article…

https://altcoinirareview.com/a-circular-economy-unveiling-the-four-bitcoiner-archetypes/