Have you heard the news? Bitcoin just skyrocketed to over $117,500, bouncing back from a recent low of $114,278. This exciting surge follows a groundbreaking decision by President Donald Trump that could revolutionize the world of cryptocurrencies, particularly Bitcoin. Let's dive into the details and explore the potential impact of this significant development.

The Executive Order Unveiled

Unlocking New Investment Horizons

President Trump recently signed an executive order that opens the doors for cryptocurrencies like Bitcoin to be integrated into 401(k) retirement accounts. This move signals a major shift in the investment landscape, offering American workers a broader range of options to secure their financial future.

Breaking Down the Implications

Shaping the Future of Investments

The executive order mandates a review of current guidelines on fiduciary responsibilities and outlines a clear path for including alternative assets in retirement portfolios. Collaboration between regulatory bodies aims to modernize investment options, potentially benefiting millions of Americans seeking stronger financial outcomes.

The Ripple Effect on Bitcoin

A Game-Changer for Cryptocurrency Adoption

Galaxy Digital CEO, Mike Novogratz, emphasized the significant influx of capital that could flow into Bitcoin and other cryptos following Trump's directive. This move has the potential to reshape the crypto landscape, attracting substantial investments and driving further growth.

- If crypto captures 1% of the $8 trillion 401k market: $80 billion

- If crypto captures 5% of the market: $400 billion

- If crypto captures 10% of the market: $800 billion

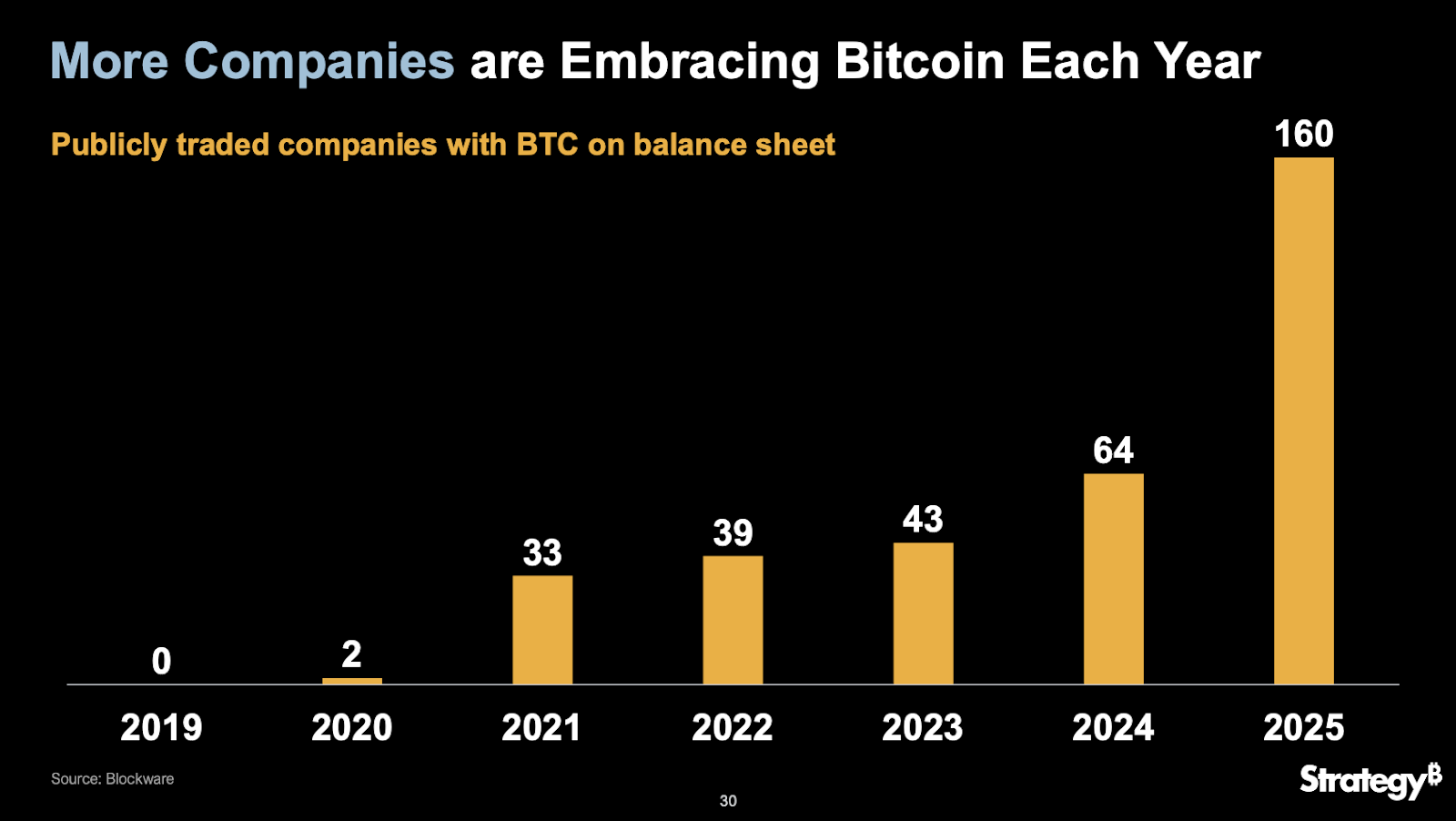

The Rise of Institutional Interest

Shifting Investment Trends

Institutions have been increasingly drawn to Bitcoin, with a notable surge in purchases compared to mining activities. The growing institutional adoption of Bitcoin underscores its evolving role as a valuable asset class, with significant potential for future growth.

The Corporate Bitcoin Boom

New Players in the Game

Companies like Nakamoto and Twenty One Capital are leading the charge in corporate Bitcoin holdings. Nakamoto's strategic moves and Twenty One Capital's substantial BTC reserves highlight the expanding influence of corporate entities in the crypto sphere, setting the stage for a new era of digital asset management.

Exciting times lie ahead for Bitcoin and the broader crypto market as Trump's executive order sets the stage for a transformative period in the world of investments. Stay tuned for more updates on this evolving story!

Curious to explore further? Check out the original article here on Bitcoin Magazine, penned by the insightful Nik.

Frequently Asked Questions

Can the government seize your gold?

Because you have it, the government can't take it. You worked hard to earn it. It belongs entirely to you. This rule could be broken by exceptions. You can lose your gold if you have been convicted for fraud against the federal governments. Your precious metals can also be lost if you owe tax to the IRS. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

How to Open a Precious Metal IRA?

First, decide if an Individual Retirement Account is right for you. You must complete Form 8606 to open an account. To determine which type of IRA you qualify for, you will need to fill out Form 5204. This form must be submitted within 60 days of the account opening. Once this has been completed, you can begin investing. You can also choose to pay your salary directly by making a payroll deduction.

For a Roth IRA you will need to complete Form 8903. Otherwise, the process will be identical to an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS says you must be 18 years old and have earned income. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Contributions must be made regularly. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

You can invest in precious metals IRAs to buy gold, palladium and platinum. You can only purchase bullion in physical form. You won't have the ability to trade stocks or bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option is offered by some IRA providers.

There are two major drawbacks to investing via an IRA in precious metals. First, they're not as liquid as stocks or bonds. It is therefore harder to sell them when required. Second, they don't generate dividends like stocks and bonds. Therefore, you will lose more money than you gain over time.

How does a gold IRA work?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase gold bullion coins in physical form at any moment. You don't have a retirement date to invest in gold.

The beauty of owning gold as an IRA is you can hold on to it forever. Your gold assets will not be subjected tax upon your death.

Your heirs inherit your gold without paying capital gains taxes. Because your gold doesn't belong to the estate, it's not necessary to include it on your final estate plan.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). After you do this, you will be granted an IRA custodian. This company acts as a middleman between you and the IRS.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. The minimum deposit is $1,000. The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

When you withdraw your gold from your IRA, you'll pay taxes on it. You will be liable for income taxes and penalties if you take the entire amount.

You may not be required to pay taxes if you take out only a small amount. There are some exceptions, though. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. You could end up with severe financial consequences.

What does gold do as an investment?

The supply and demand for gold affect the price of gold. It is also affected by interest rates.

Due to the limited supply of gold, prices for gold are highly volatile. You must also store physical gold somewhere to avoid the risk of it becoming stale.

Can I buy gold using my self-directed IRA

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. Transfer funds from an existing retirement account are also possible.

Individuals can contribute as much as $5,500 per year ($6,500 if married filing jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contract are financial instruments that depend on the gold price. These contracts allow you to speculate on future gold prices without actually owning it. Physical bullion, however, is real gold and silver bars that you can hold in your hand.

Is gold buying a good retirement option?

While buying gold as an investment may seem unattractive at first glance it becomes worth the effort when you consider how much gold is consumed worldwide each year.

The most popular form of investing in gold is through physical bullion bars. There are many ways to invest your gold. Research all options carefully and make an informed decision about what you desire from your investments.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you need cash flow from an investment, purchasing gold stocks is a good choice.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs can include stocks of precious metals refiners and gold miners.

Can I have physical gold in my IRA

Not just paper money or coins, gold is money. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

Gold has historically performed better during financial panics than other assets. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Your shares will still be yours even if your stock portfolio drops. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold provides liquidity. This allows you to sell your gold whenever you want, unlike many other investments. You can buy gold in small amounts because it is so liquid. This allows you to profit from short-term fluctuations on the gold market.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

bbb.org

irs.gov

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

How To

3 Ways To Invest in Gold For Retirement

It is important to understand the role of gold in your retirement plan. There are many ways to invest in gold if you have a 401k account at work. You might also consider investing in gold outside your workplace. For example, if you own an IRA (Individual Retirement Account), you could open a custodial account at a brokerage firm such as Fidelity Investments. If precious metals aren't your thing, you may be interested in buying them from a dealer.

These are three easy rules to remember if you invest in gold.

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, deposit cash into your accounts. This will protect your against inflation and increase your purchasing power.

- Physical Gold Coins You Should Buy – Physical gold coins should be purchased over a paper certificate. The reason is that it's much easier to sell physical gold coins than certificates. Also, there are no storage fees associated with physical gold coins.

- Diversify Your Portfolio. Never place all your eggs in the same basket. In other words, spread your wealth around by investing in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————–

By: Nik

Title: Bitcoin Reaches New Heights at $117K with Trump's Game-Changing Crypto Move

Sourced From: bitcoinmagazine.com/markets/bitcoin-surges-to-117k-as-trump-signs-401k-crypto-order-plans

Published Date: Thu, 07 Aug 2025 19:59:06 +0000