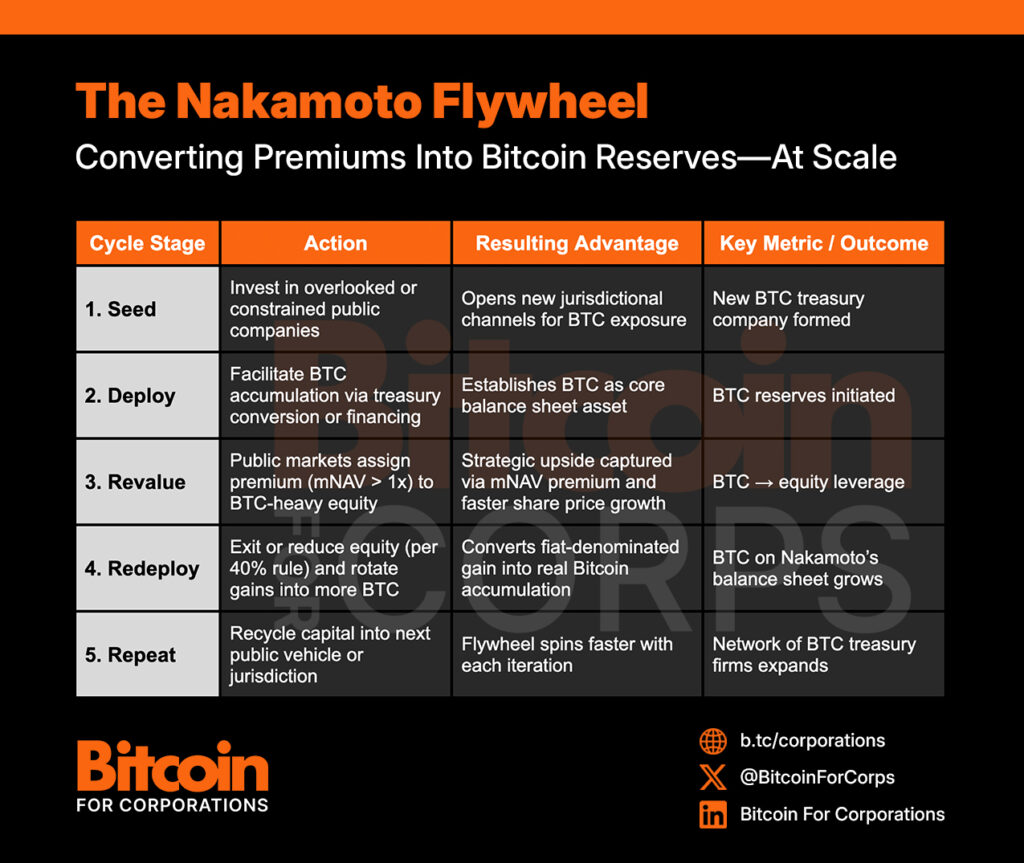

The world of Bitcoin is evolving, and the Nakamoto strategy is at the forefront of this transformation. Let's dive into how Nakamoto is reshaping capital formation in the Bitcoin era and what it means for the future of global finance.

The Vision Behind Nakamoto's Strategy

Let's uncover the core principles of the Nakamoto strategy and how it's more than just holding Bitcoin on a balance sheet. Nakamoto's approach intertwines Bitcoin with public equity, strategically investing in promising public companies to foster a decentralized financial ecosystem.

The Impact of UTXO Management

Discover how UTXO Management has set the stage by supporting leading Bitcoin treasury companies like Metaplanet, The Smarter Web Company, and The Blockchain Group. With substantial capital backing, Nakamoto is poised to expand this strategy globally, building a robust network of Bitcoin treasury companies.

The Nakamoto Strategy Unveiled

Unlocking Market Access Potential

Learn how Nakamoto's strategy leverages market access limitations, creating opportunities to establish Bitcoin treasury companies in regions where direct Bitcoin investment is restricted. By strategically deploying Bitcoin and enabling public market revaluation, Nakamoto paves the way for exponential growth.

Driving Value Through BTC Yield

Explore how Nakamoto's focus on Bitcoin-denominated metrics, such as BTC Yield, sets it apart. By compounding Bitcoin holdings efficiently and recycling gains without dilution, Nakamoto aims to outperform Bitcoin itself, attracting investors seeking superior returns.

Expanding Bitcoin Exposure through Public Markets

Understand the advantages of Nakamoto's public market approach, offering transparency, liquidity, and efficient capital recycling. By operating in real-time with regulatory compliance, Nakamoto scales its strategy globally, positioning Bitcoin as the core reserve asset.

The 40% Rule and Bitcoin Reinvestment

Delve into the intricacies of Nakamoto's compliance with the Investment Company Act and how it navigates the 40% securities threshold. Witness how Nakamoto strategically reinvests gains from equity back into Bitcoin, fostering continuous BTC accumulation.

Strategic Tools: Bitcoin-Denominated Convertible Notes

Explore Nakamoto's innovative use of Bitcoin-denominated convertible notes to manage regulatory constraints and mitigate volatility. These instruments offer flexibility and compliance, aligning capital strategy with performance objectives.

Addressing Criticisms: A Closer Look at Nakamoto's Strategy

From Tax Complexities to Narrative Risks

Unravel the concerns surrounding tax implications and mNAV premiums, and how Nakamoto mitigates risks through structured equity-based models. By emphasizing BTC Yield and governance influence, Nakamoto maintains a robust strategy amidst market uncertainties.

Setting Nakamoto Apart

Understand Nakamoto's unique position in the financial landscape and how it bridges the gap between traditional institutions and Bitcoin-native capital. By staying ahead in deal flow and compliance, Nakamoto emerges as a pivotal player in reshaping global finance.

Final Thoughts: Nakamoto's Impact on Bitcoin Capital Markets

Witness how Nakamoto's forward-thinking strategy is revolutionizing Bitcoin treasury companies worldwide. With a strong foundation, operational excellence, and a commitment to Bitcoin's growth, Nakamoto is propelling the future of finance into uncharted territories.

Join the Bitcoin revolution with Nakamoto's cutting-edge strategy. Explore the future of Bitcoin treasury companies and be part of a transformative journey in global finance.

Frequently Asked Questions

How is gold taxed within a Roth IRA

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. Any gains made by you after investing $1,000 in a stock or mutual fund are subject to tax.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

The rules that govern these accounts differ from one state to the next. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York is open until 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Which precious metals are best to invest in retirement?

These precious metals are among the most attractive investments. They're both easy to buy and sell and have been around forever. They are a great way to diversify your portfolio.

Gold: Gold is one of man's oldest forms of currency. It is very stable and secure. Because of this, it is considered a great way of preserving wealth during times when there are uncertainties.

Silver: Silver has always been popular among investors. It's an ideal choice for those who prefer to avoid volatility. Silver tends instead to go up than down, which is unlike gold.

Platinium is another precious metal that is becoming increasingly popular. Like gold and silver, it's very durable and resistant to corrosion. It's also more expensive than the other two.

Rhodium – Rhodium is used to make catalytic conversions. It's also used in jewelry making. It is relatively affordable when compared to other types.

Palladium: Palladium, which is a form of platinum, is less common than platinum. It's also less expensive. It's a popular choice for investors who want to add precious metals into their portfolios.

How Does Gold Perform as an Investment?

Gold's price fluctuates depending on the supply and demand. Interest rates are also a factor.

Because of their limited supply, gold prices can fluctuate. You must also store physical gold somewhere to avoid the risk of it becoming stale.

Can I buy gold using my self-directed IRA

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

If you do decide to invest in gold, you'll want to consider purchasing physical bullion rather than investing in futures contracts. Futures contracts are financial instruments that are based on gold's price. These financial instruments allow you to speculate about future prices without actually owning the metal. However, physical bullion is real gold or silver bars you can hold in your hands.

How much money should my Roth IRA be funded?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. These accounts are not allowed to be withdrawn before the age of 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. You cannot touch your principal (the amount you originally deposited). This means that you can't take out more money than you originally contributed. If you are able to take out more that what you have initially contributed, you must pay taxes.

The second rule is that you cannot withdraw your earnings without paying income taxes. Also, taxes will be due on any earnings you take. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's also say that you earn $10,000 per annum after contributing. Federal income taxes would apply to the earnings. You would be responsible for $3500 The remaining $6,500 is yours. You can only take out what you originally contributed.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). So, even though you ended up with $7,000 in your Roth IRA, you only got back $4,000.

Two types of Roth IRAs are available: Roth and traditional. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. You can withdraw your contributions plus interest from your traditional IRA when you retire. There are no restrictions on the amount you can withdraw from a Traditional IRA.

Roth IRAs won't let you deduct your contributions. You can withdraw your entire contribution, plus accrued interests, after you retire. There is no minimum withdrawal amount, unlike traditional IRAs. You don't have to wait until you turn 70 1/2 years old before withdrawing your contribution.

How does a gold IRA work?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase physical bullion gold coins at any point in time. You don’t have to wait to begin investing in gold.

The beauty of owning gold as an IRA is you can hold on to it forever. Your gold holdings will not be subject to tax when you are gone.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. Your gold is not part of your estate and you don't have to include it in the final estate report.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). Once you've done that, you'll receive an IRA custody. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual returns.

Once you've established your gold IRA, you'll be able to purchase gold bullion coins. Minimum deposit is $1,000 If you make more, however, you will get a higher interest rate.

Taxes will apply to gold that you take out of an IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

However, if you only take out a small percentage, you may not have to pay taxes. There are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

Avoid taking out more that 50% of your total IRA assets each year. If you do, you could face severe financial consequences.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

bbb.org

cftc.gov

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement funds

How To

The History of Gold as an Asset

Gold was a currency from ancient times until the early 20th century. It was popular because of its purity, divisibility. uniformity. scarcity and beauty. Aside from its inherent value, it could be traded internationally. Because there were no internationally recognized standards for measuring and weighing gold, the different weights of this metal could be used worldwide. One pound sterling in England was equivalent to 24 carats silver, while one livre tournois in France was equal 25 carats. In Germany, one mark was equivalent to 28 carats.

In the 1860s the United States began issuing American currency made up 90% copper (10% zinc) and 0.942 gold (0.942 pure). This led to a decrease of demand for foreign currencies which in turn caused their prices to rise. The price of gold dropped because the United States began to mint large quantities of gold coins. The U.S. government needed to find a solution to their debt because there was too much money in circulation. They decided to sell some excess gold to Europe in order to do this.

Many European countries began accepting gold in exchange for the dollar because they did not trust it. However, many European nations stopped using gold to pay after World War I and started using paper currency instead. The price of gold has risen significantly since then. Even though the price of gold fluctuates, it remains one the best investments you can make.

—————————————————————————————————————————————————————————————–

By: Nick Ward

Title: The Nakamoto Strategy: Revolutionizing Bitcoin Treasury Companies Across Global Markets

Sourced From: bitcoinmagazine.com/news/nakamoto-seeding-bitcoin-treasury-companies

Published Date: Thu, 03 Jul 2025 10:26:07 +0000