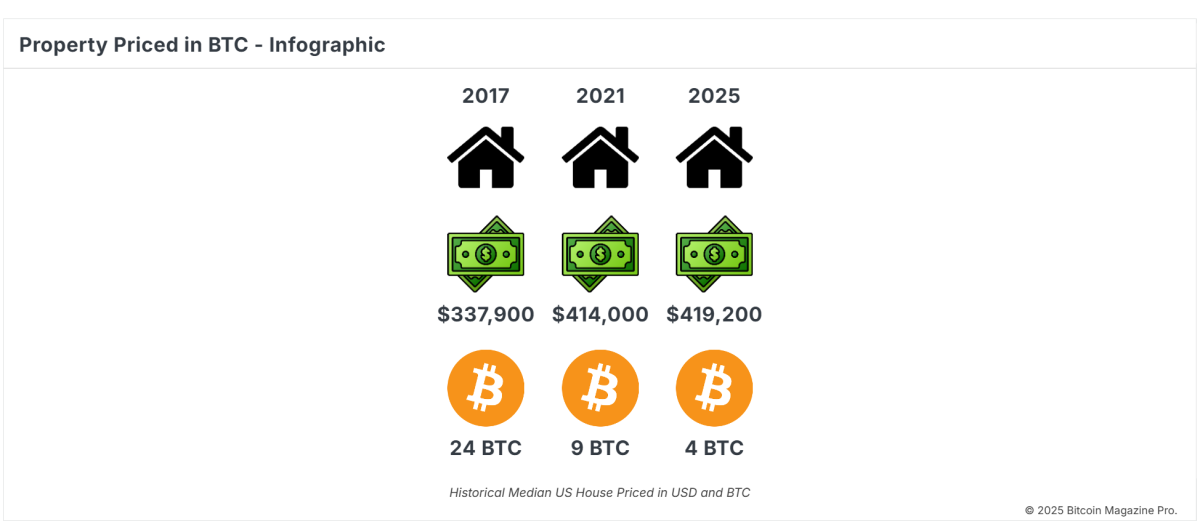

In today’s ever-changing economic landscape, experienced investors are reassessing their investment portfolios and looking at Bitcoin as a viable alternative to traditional assets like real estate. With its limited supply and potential for transformative growth, Bitcoin presents a compelling option for forward-thinking investment strategies.

Real Estate: The Perception of Stability

Real estate has traditionally been seen as a secure investment for wealth preservation. However, the housing market is susceptible to systemic risks such as interest rate fluctuations, government interventions, and economic downturns. Additionally, property investments often come with high maintenance costs, taxes, and liquidity constraints.

The Emergence of Bitcoin as a Value Store

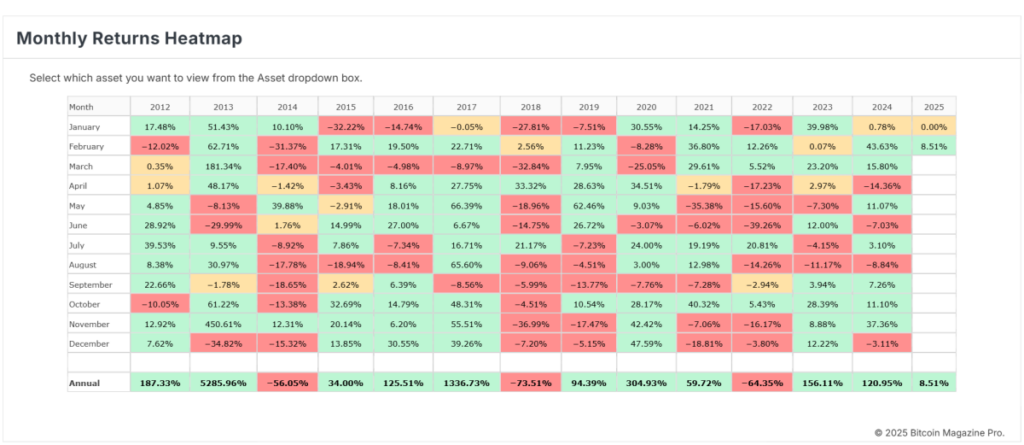

Bitcoin's capped supply of 21 million coins positions it as the "digital gold" of the modern era. Over the past decade, Bitcoin has consistently outperformed other asset classes, offering substantial returns despite its volatility. In contrast, the appreciation of real estate is typically tied to inflation and monetary policies, which may erode its true value over time. Bitcoin, on the other hand, operates on a deflationary model, ensuring scarcity and retaining purchasing power.

Liquidity and Accessibility

Investing in real estate often involves lengthy processes, high transaction fees, and regulatory obstacles. Selling a property can be a time-consuming endeavor, tying up capital and limiting flexibility. Conversely, Bitcoin provides immediate liquidity and can be traded around the clock on global platforms, enabling investors to transfer their assets seamlessly across borders.

Hedging Against Inflation

While real estate prices tend to follow inflation trends, they may not outpace them significantly. Bitcoin, designed as a hedge against fiat currency devaluation, has proven its resilience during inflationary periods. As central banks continue to increase money supply at unprecedented levels, Bitcoin's finite nature safeguards its value against currency devaluation.

Flexibility for Contemporary Investors

Modern investors prioritize flexibility and global accessibility in their investment choices. Real estate, being a localized and illiquid asset, can impede mobility. In contrast, Bitcoin is borderless and allows for decentralized ownership independent of traditional financial systems. This attribute is particularly appealing to tech-savvy investors seeking freedom and autonomy.

A Visionary Outlook

Bitcoin represents not just a speculative asset but a financial revolution. By embracing Bitcoin, astute investors position themselves at the forefront of this paradigm shift. As Bitcoin gains wider acceptance, its value proposition as a robust, deflationary asset tailored for the contemporary economy becomes increasingly evident.

While real estate has historically been a fundamental component of investment portfolios, Bitcoin presents a disruptive alternative that aligns with the requirements of a rapidly evolving global economy. For those looking to safeguard wealth, hedge against inflation, and leverage cutting-edge technology, Bitcoin emerges as the preferred asset. The question shifts from "Why Bitcoin?" to "Why not Bitcoin?"

If you desire more extensive analysis and real-time insights, consider exploring Bitcoin Magazine Pro for valuable information on the Bitcoin market.

Disclaimer: This article serves as informational content and should not be construed as financial advice. It is always advisable to conduct thorough research before making any investment decisions.

Frequently Asked Questions

Is it a good retirement strategy to buy gold?

Although buying gold as an investment might not sound appealing at first, when you look at the average annual gold consumption worldwide, it is worth looking into.

The best form of investing is physical bullion, which is the most widely used. There are other ways to invest gold. The best thing to do is research all options thoroughly and then make an informed decision based on what you want from your investments.

If you don't want to keep your wealth safe, buying shares in companies that extract gold and mining equipment could be a better choice. If you require cash flow, gold stocks can work well.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs may include stocks that are owned by gold miners or precious metals refining companies as well as commodity trading firms.

What is the tax on gold in an IRA

The tax on the sale of gold is based on its fair market value when sold. You don't have tax to pay when you buy or sell gold. It is not income. If you decide to make a sale of it, you'll be entitled to a taxable loss if the value goes up.

As collateral for loans, gold is possible. Lenders will seek the highest return on your assets when you borrow against them. This usually involves selling your gold. The lender might not do this. They might just hold onto it. They might decide that they want to resell it. Either way, you lose potential profit.

In order to avoid losing your money, only lend against your precious metal if you plan to use it to secure other collateral. It's better to keep it alone.

Who is the owner of the gold in a gold IRA

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

To find out what options you have, consult an accountant or financial planner.

What Is a Precious Metal IRA?

A precious metal IRA allows for you to diversify your retirement savings in gold, silver, palladium and iridium. These rare metals are often called “precious” as they are very difficult to find and highly valuable. These are excellent investments that will protect your wealth from inflation and economic instability.

Precious metals are often referred to as “bullion.” Bullion is the physical metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

An IRA for precious metals allows you to directly invest in bullion instead of purchasing stock shares. This means you'll receive dividends every year.

Precious metal IRAs have no paperwork or annual fees. You pay only a small percentage of your gains tax. Plus, you get free access to your funds whenever you want.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

bbb.org

forbes.com

- Gold IRA: Sparkle Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

investopedia.com

How To

The best place to buy silver or gold online

You must first understand the workings of gold before you can purchase it. Gold is a precious metallic similar to Platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They are not exchangeable in any currency exchange system. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. For every dollar spent, the buyer gets 1 gram of Gold.

The next thing you should know when looking to buy gold is where to do it from. If you want to purchase gold directly from a dealer, then a few options are available. First, you can visit your local coin store. You can also try going through a reputable website like eBay. You can also purchase gold through private online sellers.

Individuals selling gold at wholesale prices and retail prices are known as private sellers. You pay a commission fee between 10% and 15% for each transaction when you sell gold through private sellers. You would receive less money from a private buyer than you would from a coin store or eBay. This is a great option for gold investing because you have more control over the item’s price.

Another option for buying gold is to invest in physical gold. While physical gold is easier than paper certificates to store, you still need to make sure it is safe. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

A bank or pawnshop can help you buy gold. A bank can provide you with a loan to cover the amount you wish to invest in gold. These are small businesses that let customers borrow money against the items they bring to them. Banks charge higher interest rates than those offered by pawn shops.

The final option is to ask someone to buy your gold! Selling gold can also be done easily. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————–

By: Mark Mason

Title: Why Smart Investors Choose Bitcoin Over Real Estate

Sourced From: bitcoinmagazine.com/markets/why-smart-investors-buy-bitcoin-not-real-estate

Published Date: Tue, 04 Feb 2025 21:16:01 GMT