The recent divergence in U.S. Treasury yields, where shorter-term yields have been declining while longer-term yields are on the rise, has sparked significant interest across financial markets. This development provides critical insights into macroeconomic conditions and potential strategies for Bitcoin investors navigating these uncertain times.

Treasury Yield Dynamics

Treasury yields reflect the return investors demand to hold U.S. government debt, and they are a critical barometer for the economy and monetary policy expectations. Here’s a snapshot of what’s happening:

Short-term Yields Falling

Declining yields on short-term Treasury bonds, such as the 6-month yield, suggest that markets are anticipating the Federal Reserve will pivot to rate cuts in response to economic slowdown risks or lower inflation expectations.

Long-term Yields Rising

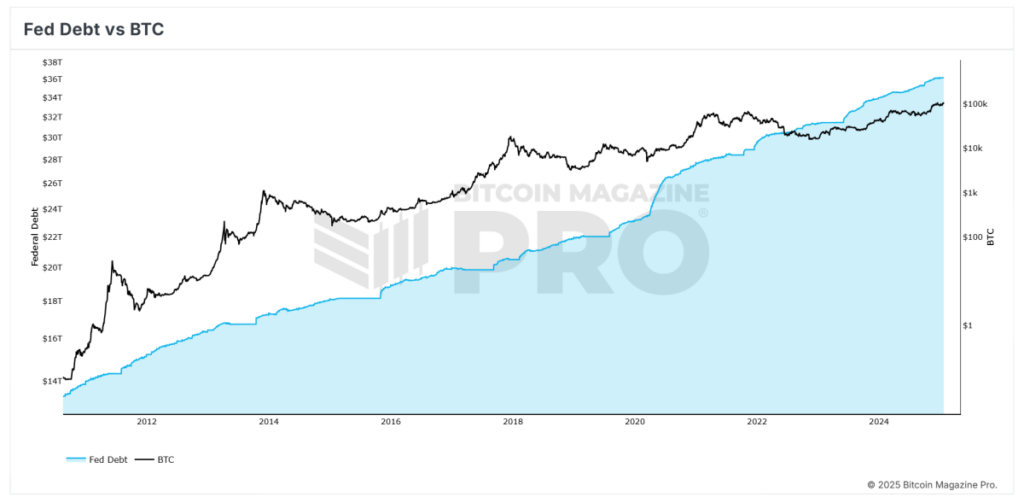

Meanwhile, rising yields on longer-term bonds, like the 10-year Treasury yield, indicate growing concerns about persistent inflation, fiscal deficits, or higher-term premiums required by investors for holding long-duration debt.

This divergence in yields often hints at a shifting economic landscape and can serve as a signal for investors to recalibrate their portfolios.

Why Treasury Yields Matter for Bitcoin Investors

Bitcoin’s unique properties as a non-sovereign, decentralized asset make it particularly sensitive to macroeconomic trends. The current yield environment could shape Bitcoin’s narrative and performance in several ways:

Inflation Hedge Appeal

Rising long-term yields may reflect persistent inflation concerns. Historically, Bitcoin has been seen as a hedge against inflation and currency debasement, potentially increasing its appeal to investors looking to protect their wealth.

Risk-On Sentiment

Declining short-term yields could indicate looser financial conditions ahead. Easier monetary policy often fosters a risk-on environment, benefiting assets like Bitcoin as investors seek higher returns.

Financial Instability Hedge

Divergence in yields, particularly if it leads to an inverted yield curve, can signal economic instability or recession risks. During such periods, Bitcoin’s narrative as a safe-haven asset and alternative to traditional finance may gain traction.

Liquidity Considerations

Lower short-term yields reduce borrowing costs, potentially leading to increased liquidity in the financial system. This liquidity often spills into risk assets, including Bitcoin, fueling upward price momentum.

Broader Market Insights

The impact of yield divergence extends beyond Bitcoin to other areas of the financial ecosystem:

Stock Market

Lower short-term yields typically boost equities by reducing borrowing costs and supporting valuation multiples. However, rising long-term yields can pressure growth stocks, particularly those sensitive to higher discount rates.

Debt Sustainability

Higher long-term yields increase the cost of financing for governments and corporations, potentially straining heavily indebted entities and creating ripple effects across global markets.

Economic Outlook

The divergence could reflect market expectations of slower near-term growth coupled with longer-term inflationary pressures, signaling potential stagflation risks.

Takeaways for Bitcoin Investors

For Bitcoin investors, understanding the interplay between Treasury yields and macroeconomic trends is essential for informed decision-making. Here are some key takeaways:

Monitor Monetary Policy

Keep a close eye on Federal Reserve announcements and economic data. A dovish pivot could create tailwinds for Bitcoin, while tighter policy might pose short-term challenges.

Diversify and Hedge

Rising long-term yields could lead to volatility across asset classes. Diversifying into Bitcoin as part of a broader portfolio strategy may help hedge against inflation and economic uncertainty.

Leverage Bitcoin’s Narrative

In an environment of fiscal deficits and monetary easing, Bitcoin’s story as a non-inflationary store of value becomes more compelling. Educating new investors on this narrative could drive further adoption.

The divergence in Treasury yields underscores shifting market expectations around growth, inflation, and monetary policy—factors that have far-reaching implications for Bitcoin and broader financial markets. For investors, understanding these dynamics and positioning accordingly can unlock opportunities to capitalize on Bitcoin’s unique role in a rapidly changing economic landscape. As always, staying informed and proactive is key to navigating these complex times.

For ongoing access to live data, advanced analytics, and exclusive content, visit BitcoinMagazinePro.com.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct thorough independent research before making investment decisions.

Frequently Asked Questions

What precious metals could you invest in to retire?

Gold and silver are the best precious metal investments. Both are easy to sell and can be bought easily. These are great options to diversify your portfolio.

Gold: Gold is one the oldest forms currency known to man. It is very stable and secure. Because of this, it is considered a great way of preserving wealth during times when there are uncertainties.

Silver: Silver is a popular investment choice. It's a good choice for those who want to avoid volatility. Unlike gold, silver tends to go up instead of down.

Platinum: This precious metal is also becoming more popular. Like gold and silver, it's very durable and resistant to corrosion. However, it's much more expensive than either of its counterparts.

Rhodium. Rhodium is used as a catalyst. It is also used to make jewelry. It is relatively affordable when compared to other types.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also more accessible. For these reasons, it's become a favorite among investors looking to add precious metals to their portfolios.

What is the tax on gold in Roth IRAs?

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. If you invest $1,000 into a mutual fund, stock, or other investment account, then any gains are subjected tax.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. You pay taxes only on earnings from dividends and capital gains — which apply only to investments held longer than one year.

The rules governing these accounts vary by state. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. In Massachusetts, you can wait until April 1st. And in New York, you have until age 70 1/2 . To avoid penalties, plan ahead so you can take distributions at the right time.

How can I withdraw from a Precious metal IRA?

First decide if your IRA account allows you to withdraw funds. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. If you decide to go with this option, you will need to take into account the taxes due on the amount you withdraw.

Next, you'll need to figure out how much money you will take out of your IRA. This calculation is dependent on several factors like your age when you take the money out, how long you have had the account, and whether or not your plan to continue contributing.

Once you know what percentage of your total savings you'd like to convert into cash, you'll need to determine which type of IRA you want to use. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. Brokers often offer promotional offers and signup bonuses to encourage people into opening accounts. It is better to open an account with a debit than a creditcard in order to avoid any unnecessary fees.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. While some storage facilities accept bullion bars and others require that you purchase individual coins, others will allow you to store your coins in their own safe. Before choosing one, consider the pros and disadvantages of each.

For example, storing bullion bars requires less space because you aren't dealing with individual coins. But, each coin must be counted separately. On the flip side, storing individual coins allows you to easily track their value.

Some people prefer to keep their coins in a vault. Others prefer to store them in a safe deposit box. No matter what method you use, it is important to keep your bullion safe so that you can reap its benefits for many more years.

What are the advantages of a IRA with a gold component?

A gold IRA has many benefits. It is an investment vehicle that can diversify your portfolio. You decide how much money is put in each account and when it is withdrawn.

You also have the option to transfer funds from other retirement plans into a IRA. This will allow you to transition easily if it is your decision to retire early.

The best part is that you don't need special skills to invest in gold IRAs. These IRAs are available at all banks and brokerage houses. You don't have to worry about penalties or fees when withdrawing money.

That said, there are drawbacks too. Gold has always been volatile. It's important to understand the reasons you're considering investing in gold. Is it for growth or safety? Do you want to use it as an insurance strategy or for long-term growth? Only when you are clear about the facts will you be able take an informed decision.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. A single ounce isn't enough to cover all of your needs. Depending on your plans for using your gold, you may need multiple ounces.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even manage with one ounce. However, you will not be able buy any other items with those funds.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

finance.yahoo.com

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds

irs.gov

How To

Online buying gold and silver is the best way to purchase it.

You must first understand the workings of gold before you can purchase it. Gold is a precious metal similar to platinum. Because of its resistance to corrosion and durability, it is very rare. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They cannot be used in currency exchanges. A person can buy 100 grams of gold for $100. The buyer receives 1 gram of gold for every dollar spent.

The next thing you should know when looking to buy gold is where to do it from. If you want to purchase gold directly from a dealer, then a few options are available. First off, you can go through your local coin shop. You could also look into eBay or other reputable websites. You may also be interested in buying gold through private sellers online.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers typically charge 10% to 15% commission on each transaction. A private seller will usually return less money than a coin shop and eBay. This option is often a great choice for investing gold as it allows you more control over its price.

Another way to buy gold is by investing in physical gold. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

You can either visit a bank, pawnshop or bank to buy gold. A bank can offer you a loan for the amount that you need to buy gold. These are small businesses that let customers borrow money against the items they bring to them. Banks typically charge higher interest rates than pawn shops.

Another way to purchase gold is to ask another person to do it. Selling gold is easy too. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————–

By: Mark Mason

Title: The Significance of U.S. Treasury Yield Divergence for Bitcoin Investors

Sourced From: bitcoinmagazine.com/markets/how-declining-short-term-u-s-treasury-yields-impact-bitcoin-price

Published Date: Mon, 27 Jan 2025 18:54:56 GMT