Nasdaq has put forth a revolutionary proposal to the U.S. Securities and Exchange Commission (SEC) that could revolutionize the operational structure of Bitcoin exchange-traded funds (ETFs). The proposal is centered around BlackRock’s iShares Bitcoin Trust (IBIT) and aims to introduce "in-kind" bitcoin redemptions, providing a more efficient and cost-effective alternative to the current cash redemption process.

Transformative Proposal by Nasdaq

Under the proposed system, authorized participants (APs), who are institutional players responsible for creating and redeeming ETF shares, would have the option to exchange ETF shares directly for bitcoin instead of cash. This innovative approach eliminates the need to sell bitcoin to obtain cash for redemptions, simplifying the process and reducing operational expenses.

Benefits of In-Kind Redemptions

1. Operational Efficiency:

– Simplifies and streamlines the redemption process.

– Saves time and reduces costs in ETF operations.

2. Tax Advantages:

– By avoiding the sale of bitcoin, capital gains distributions are minimized, making ETFs more tax-efficient for institutional investors.

3. Market Stability:

– Decreases sell pressure on bitcoin during redemptions, potentially stabilizing the asset's price.

Reasons for the Proposed Change

The cash redemption model, which was introduced in January 2024 with the approval of spot Bitcoin ETFs by the SEC, aimed to prevent financial institutions and brokers from directly handling bitcoin. However, with the growth of the Bitcoin ETF market and advancements in regulations, Nasdaq and BlackRock see an opportunity to enhance the efficiency of the redemption process through in-kind redemptions.

Regulatory and Market Environment

Nasdaq’s proposal aligns with recent regulatory changes during the pro-Bitcoin Trump administration that have facilitated broader cryptocurrency adoption. The removal of barriers like Staff Accounting Bulletin 121 (SAB 121) has created a more favorable environment for innovations such as Nasdaq's in-kind redemption model.

BlackRock's Bitcoin ETF Dominance

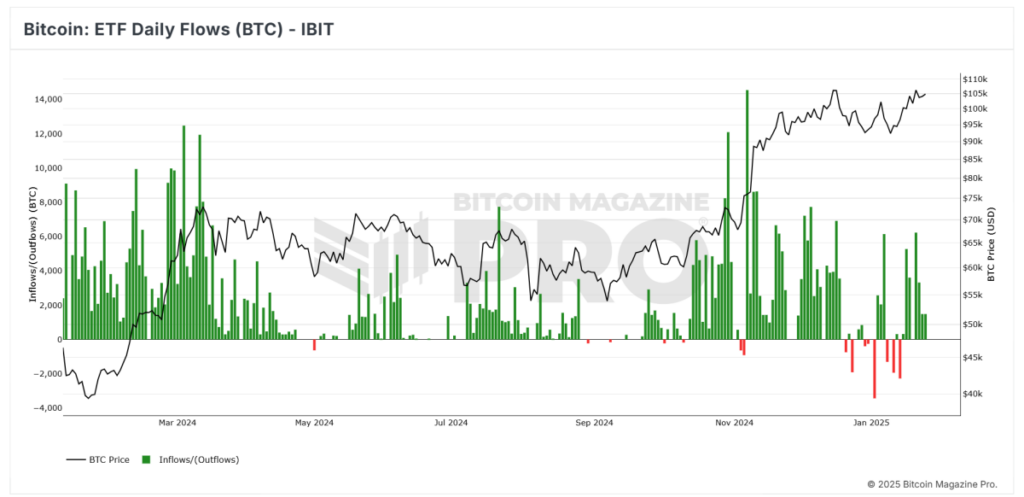

BlackRock’s iShares Bitcoin ETF has established itself as a market leader since its launch in 2024, attracting over $60 billion in inflows. The fund’s growth underscores institutional interest in Bitcoin investment products. Innovations like Nasdaq’s proposed in-kind redemption model could further bolster IBIT’s attractiveness to institutional investors.

Future Outlook

Nasdaq's groundbreaking proposal for in-kind redemptions in BlackRock's Bitcoin ETF marks a significant milestone for the Bitcoin ETF market. By simplifying redemptions, providing tax efficiencies, and reducing sell pressure on bitcoin, this model has the potential to significantly improve the appeal and performance of Bitcoin ETFs for institutional investors.

With a supportive regulatory landscape and increasing institutional participation, the future of Bitcoin ETFs appears brighter than ever, with innovations like Nasdaq’s proposal poised to drive further adoption and solidify Bitcoin ETFs as key components of institutional digital asset investment.

Frequently Asked Questions

Should You Invest in gold for Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you're unsure about which option to choose then consider investing in both.

Gold is a safe investment and can also offer potential returns. Retirement investors will find gold a worthy investment.

Although most investments promise a fixed rate of return, gold is more volatile than others. As a result, its value changes over time.

This doesn't mean that you should not invest in gold. It is important to consider the fluctuations when planning your portfolio.

Another advantage of gold is its tangible nature. Gold is more convenient than bonds or stocks because it can be stored easily. It can also be transported.

You can always access gold as long your place it safe. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. It's a great way to hedge against rising prices, as gold prices tend to increase along with other commodities.

It's also a good idea to have a portion your savings invested in something which isn't losing value. Gold usually rises when stocks fall.

Investing in gold has another advantage: you can sell it anytime you want. As with stocks, your position can be liquidated whenever you require cash. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't purchase too much at once. Begin by buying a few grams. Continue adding more as necessary.

Don't expect to be rich overnight. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

While gold may not be the best investment, it can be a great addition to any retirement plan.

How do I Withdraw from an IRA with Precious Metals?

You first need to decide if you want to withdraw money from an IRA account. After that, you need to decide if you want to withdraw funds from an IRA account. Next, make sure you have enough money in order for you pay any fees or penalties.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, figure out how much money will be taken out of your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you have an idea of the amount of your total savings you wish to convert into cash you will need to decide what type of IRA you want. Traditional IRAs allow you to withdraw funds tax-free when you turn 59 1/2 while Roth IRAs charge income taxes upfront but let you access those earnings later without paying additional taxes.

Once you have completed these calculations, you need to open your brokerage account. Most brokers offer free signup bonuses and other promotions to entice people to open accounts. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Before you choose one, weigh the pros and cons.

Bullion bars require less space, as they don't contain individual coins. But, each coin must be counted separately. However, you can easily track the value of individual coins by storing them in separate containers.

Some people like to keep their coins in vaults. Some prefer to keep them in a vault. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

Who is the owner of the gold in a gold IRA

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

This tax-free status is only available to those who have owned at least $10,000 of gold and have kept it for at minimum five years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

You will need to declare the value of gold if you intend on selling it one day. This could impact how capital gains taxes you owe for cash investments.

A financial planner or accountant should be consulted to discuss your options.

How to open a Precious Metal IRA

The first step is to decide if you want an Individual Retirement Account (IRA). Open the account by filling out Form 8606. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. You must complete this form within 60 days of opening your account. You can then start investing once you have this completed. You may also choose to contribute directly from your paycheck using payroll deduction.

You must complete Form 8903 if you choose a Roth IRA. Otherwise, it will be the same process as an ordinary IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. You must also contribute regularly. These rules apply to contributions made directly or through employer sponsorship.

You can invest in precious metals IRAs to buy gold, palladium and platinum. But, you'll only be able to purchase physical bullion. This means you can't trade shares of stock and bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option can be provided by some IRA companies.

There are two major drawbacks to investing via an IRA in precious metals. First, they're not as liquid as stocks or bonds. They are therefore more difficult to sell when necessary. They also don't pay dividends, like stocks and bonds. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

What is the best precious metal to invest in?

The answer to this question depends on how much risk you are willing to take and what type of return you want. Gold is a traditional haven investment. However, it is not always the most profitable. For example, if your goal is to make quick money, gold may not suit you. You should invest in silver if you have the patience and time.

If you don't care about getting rich quickly, gold is probably the way to go. Silver might be a better investment option if steady returns are desired over a long period of time.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

finance.yahoo.com

bbb.org

How To

How to keep physical gold in an IRA

The easiest way to invest is to buy shares in companies that make gold. This method is not without risks. There's no guarantee these companies will survive. Even if they survive, there's always the risk that they will lose money due fluctuations in gold prices.

Alternative options include buying physical gold. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. This option has many advantages, including the ease of access (you don’t have to deal with stock markets) and the ability of making purchases at low prices. It's easier to track how much gold is in your possession. You'll get a receipt showing exactly what you paid, so you'll know if any taxes were missed. You're also less susceptible to theft than investing with stocks.

However, there are disadvantages. You won't get the bank's interest rates or investment money. Additionally, you won’t be able diversify your holdings. You will remain with the same items you bought. Finally, the taxman might want to know where your gold has been placed!

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————–

By: Mark Mason

Title: Nasdaq Proposes Game-Changing In-Kind Redemptions for BlackRock's Bitcoin ETF

Sourced From: bitcoinmagazine.com/markets/nasdaq-proposes-in-kind-redemptions-for-blackrocks-bitcoin-etf

Published Date: Mon, 27 Jan 2025 14:53:53 GMT

Did you miss our previous article…

https://altcoinirareview.com/exploring-bitcoins-potential-in-depth-data-analysis-on-chain-insights/