The introduction of Bitcoin ETFs in January 2024 was anticipated to be a significant moment for the market. There were high hopes that these products would attract institutional capital and propel Bitcoin prices to unprecedented levels. However, now that a year has passed, have Bitcoin ETFs lived up to the hype?

A Promising Start

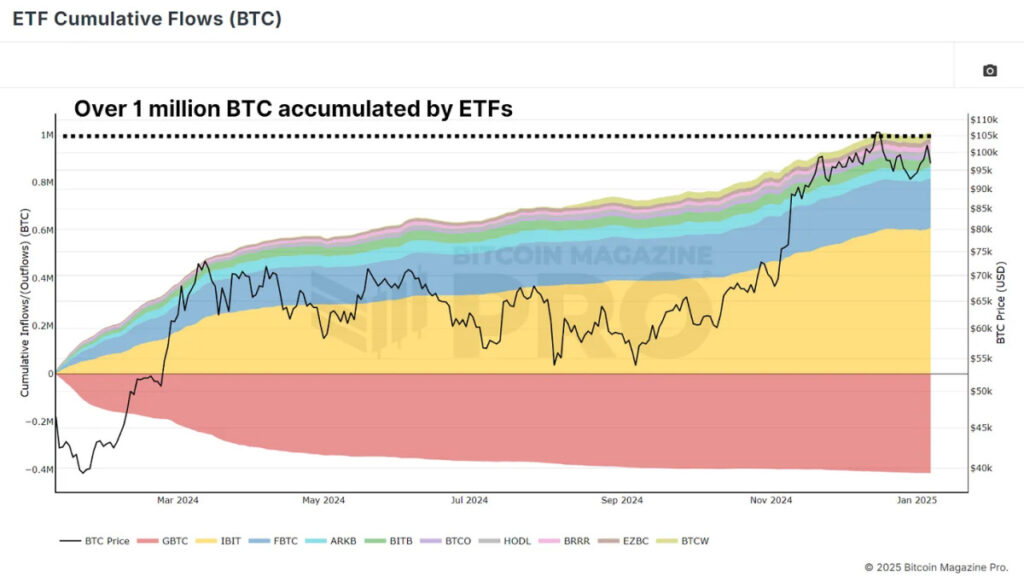

Since their inception, Bitcoin ETFs have amassed over 1 million BTC, translating to roughly $40 billion in assets under management. Despite outflows from competing products like the Grayscale Bitcoin Trust (GBTC), which experienced withdrawals of more than 400,000 BTC, the net inflows remain substantial at approximately 540,000 BTC.

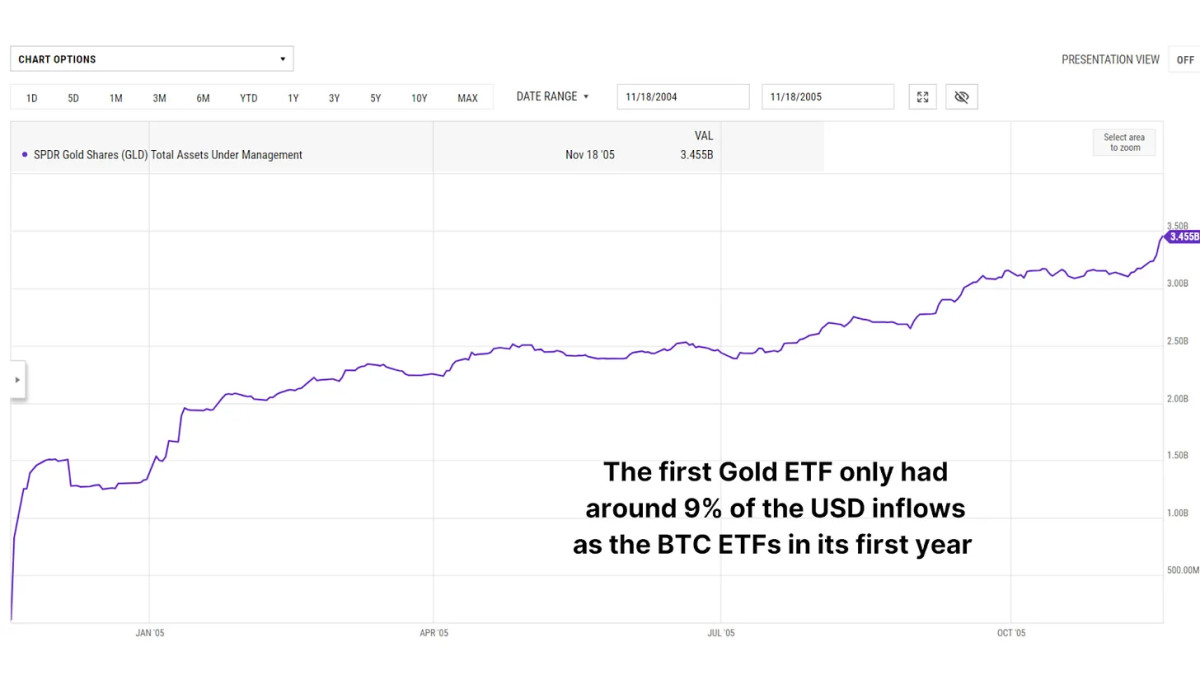

For perspective, the inflow scale significantly surpasses the initial year of gold ETFs launch in 2004. Gold ETFs attracted $3.45 billion in their first year, a fraction of the $37.5 billion inflow into Bitcoin ETFs during the same timeframe. This underscores the strong institutional interest in Bitcoin as a financial asset.

Bitcoin's Growth Trajectory

Following the rollout of Bitcoin ETFs, the initial price movements were lackluster, with Bitcoin briefly dropping by nearly 20% in a "buy the rumor, sell the news" scenario. Nonetheless, this bearish trend swiftly reversed. Over the past year, Bitcoin prices have surged by around 120%, achieving new highs. By comparison, the first year post the launch of gold ETFs saw a modest 9% price uptick for gold.

Comparing to Gold Trends

When considering Bitcoin's 24/7 trading schedule, resulting in approximately 5.3 times more yearly trading hours compared to gold, a notable similarity emerges. Overlaying Bitcoin’s ETF price action in the first year with gold's historical data (adjusted for trading hours) reveals almost identical percentage returns. If Bitcoin continues to mirror gold's pattern, a potential additional 83% price surge by mid-2025 could push Bitcoin’s value to roughly $188,000.

Institutional Investment Strategies

An intriguing observation from Bitcoin ETFs is the correlation between fund inflows and price shifts. Employing a simple strategy of purchasing Bitcoin on days with positive ETF inflows and selling on days with outflows has consistently outperformed a traditional buy-and-hold approach. From January 2024 to date, this strategy has yielded a 130% return, compared to approximately 100% for a buy-and-hold investor, marking an outperformance of nearly 10%.

Supply and Demand Dynamics

Although Bitcoin ETFs have amassed over 1 million BTC, this represents only a small fraction of Bitcoin's total circulating supply of 19.8 million BTC. Corporations like MicroStrategy have also bolstered institutional adoption by collectively holding hundreds of thousands of BTC. However, the majority of Bitcoin remains in the possession of individual investors, ensuring that market dynamics are still steered by decentralized supply and demand.

Final Thoughts

After a year, Bitcoin ETFs have surpassed expectations with substantial inflows, significant price impact, and growing institutional acceptance, cementing their role as a pivotal driver of Bitcoin's market narrative. Despite initial skeptics disappointed by the absence of immediate explosive price movements, the long-term outlook remains highly optimistic.

The parallels drawn to gold ETFs offer an intriguing roadmap for Bitcoin's future. Should the gold fractal hold true, we might be on the brink of another substantial rally. Coupled with favorable macroeconomic conditions and escalating institutional interest, Bitcoin's future appears brighter than ever.

Stay informed about Bitcoin's price trends with live data, charts, indicators, and comprehensive research at Bitcoin Magazine Pro.

Disclaimer: This content is intended for informational purposes solely and should not be construed as financial advice. Always conduct thorough research before making any investment decisions.

Frequently Asked Questions

What Does Gold Do as an Investment Option?

Supply and demand determine the gold price. It is also affected by interest rates.

Gold prices are volatile due to their limited supply. You must also store physical gold somewhere to avoid the risk of it becoming stale.

What is the tax on gold in an IRA

The fair value of gold sold to determines the price at which tax is due. When you purchase gold, you don't have to pay any taxes. It's not considered income. If you sell it later, you'll have a taxable gain if the price goes up.

You can use gold as collateral to secure loans. When you borrow against your assets, lenders try to find the highest return possible. Selling gold is usually the best option. The lender might not do this. They might keep it. They might decide to sell it. You lose potential profits in either case.

If you plan on using your gold as collateral, then you shouldn't lend against it. It is better to leave it alone.

What precious metal is best for investing?

This question is dependent on the amount of risk you are willing and able to accept as well as the type of return you desire. Although gold has been considered a safe investment, it is not always the most lucrative. For example, if you need a quick profit, gold may not be for you. If you have the patience to wait, then you might consider investing in silver.

If you're not looking to make quick money, gold is probably your best choice. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

Are You Ready to Invest in Gold?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you are unsure which option to choose, consider investing in both options.

Gold is a safe investment and can also offer potential returns. This makes it a worthwhile choice for retirees.

Although most investments promise a fixed rate of return, gold is more volatile than others. Therefore, its value is subject to change over time.

This does not mean you shouldn’t invest in gold. It is important to consider the fluctuations when planning your portfolio.

Another benefit to gold is its tangible value. Gold is much easier to store than bonds and stocks. It is also easily portable.

You can always access your gold as long as it is kept safe. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold tends to rise when the stock markets fall.

Gold investment has another advantage: You can sell it anytime. You can also liquidate your gold position at any time you need cash, just like stocks. You don't even need to wait for your retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Do not put all your eggs in one basket.

Don't purchase too much at once. Start small, buying only a few ounces. Next, add more as required.

Keep in mind that the goal is not to quickly become wealthy. Rather, it's to build up enough wealth so you won't need to rely on Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Statistics

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- Do you want to keep your IRA gold at home? It's not legal – WSJ

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

How To

A growing trend: Gold IRAs

Investors seek diversification and protection against inflation by using gold IRAs.

The gold IRA allows owners to invest in physical gold bullion and bars. It can be used for tax-free growth and provides an alternative investment option for those concerned about stocks and bonds.

A gold IRA allows investors to manage their assets without worrying about market volatility. They can use the gold IRA to protect themselves against inflation and other potential problems.

Investors also enjoy the benefits of owning physical gold, which includes its unique properties such as durability, portability, and divisibility.

In addition, the gold IRA offers several other advantages, including the ability to quickly transfer ownership of the gold to heirs and the fact that the IRS does not consider gold a currency or a commodity.

All this means that the gold IRA is becoming increasingly popular among investors seeking a haven during financial uncertainty.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Are Bitcoin ETFs Meeting Expectations?

Sourced From: bitcoinmagazine.com/markets/have-bitcoin-etfs-lived-up-to-the-hype

Published Date: Fri, 10 Jan 2025 13:30:00 GMT