Bitcoin's surge into six-figure territory has become the new norm, prompting discussions about even higher prices in the near future. Analyzing key on-chain data can offer valuable insights into the market's overall health. By delving into these metrics, investors can gain a better understanding of potential price movements and prepare for market peaks or retracements.

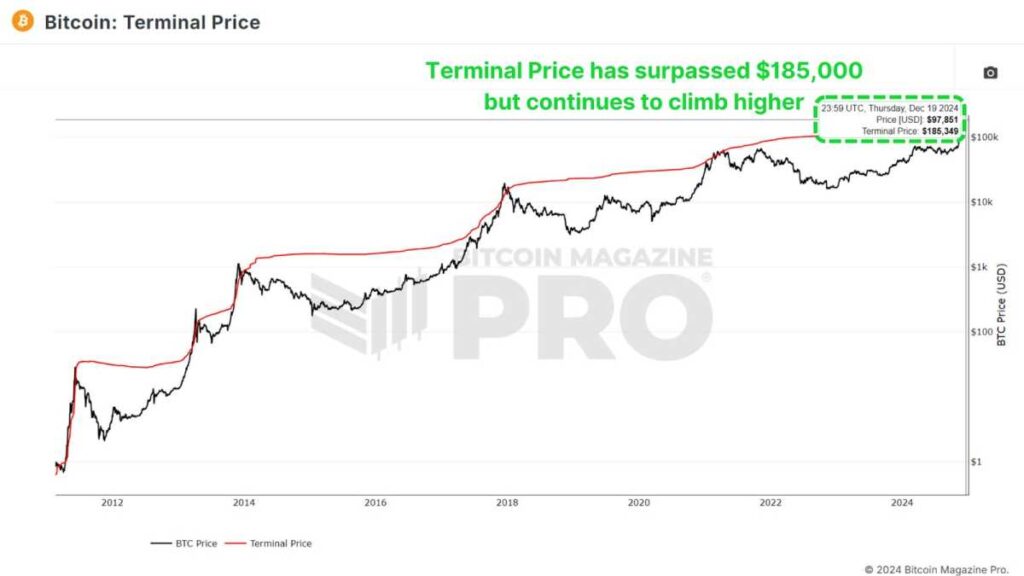

Terminal Price

The Terminal Price metric integrates Coin Days Destroyed (CDD) with Bitcoin's supply to predict Bitcoin cycle peaks accurately. CDD measures the speed of coin transfers by considering both the holding duration and the amount of Bitcoin moved.

Currently, the terminal price has exceeded $185,000 and is expected to climb towards $200,000 as the cycle advances. With Bitcoin already surpassing $100,000, this indicates that there may be several months of positive price trends ahead.

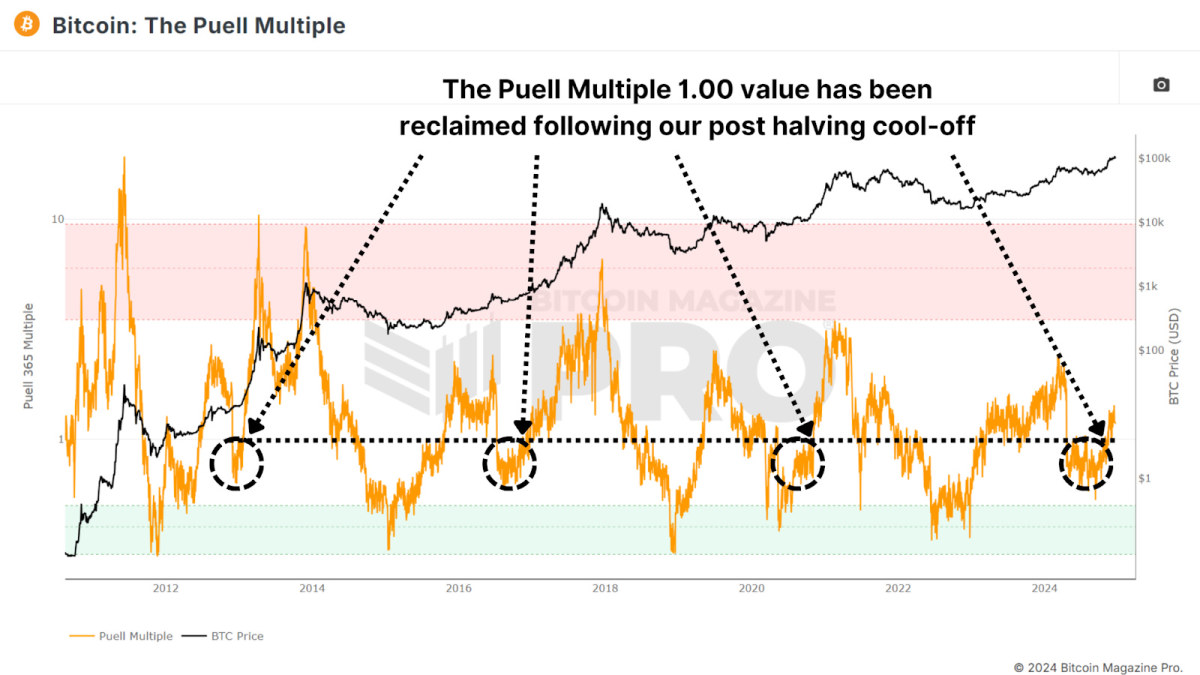

Puell Multiple

The Puell Multiple assesses daily miner revenue (in USD) in comparison to its 365-day moving average. Following the halving event, miners faced a significant revenue decline, leading to a period of consolidation.

Presently, the Puell Multiple has risen above 1, indicating a return to profitability for miners. Historically, crossing this threshold signifies the later stages of a bull cycle, often accompanied by exponential price surges. This trend has been observed in previous bull runs.

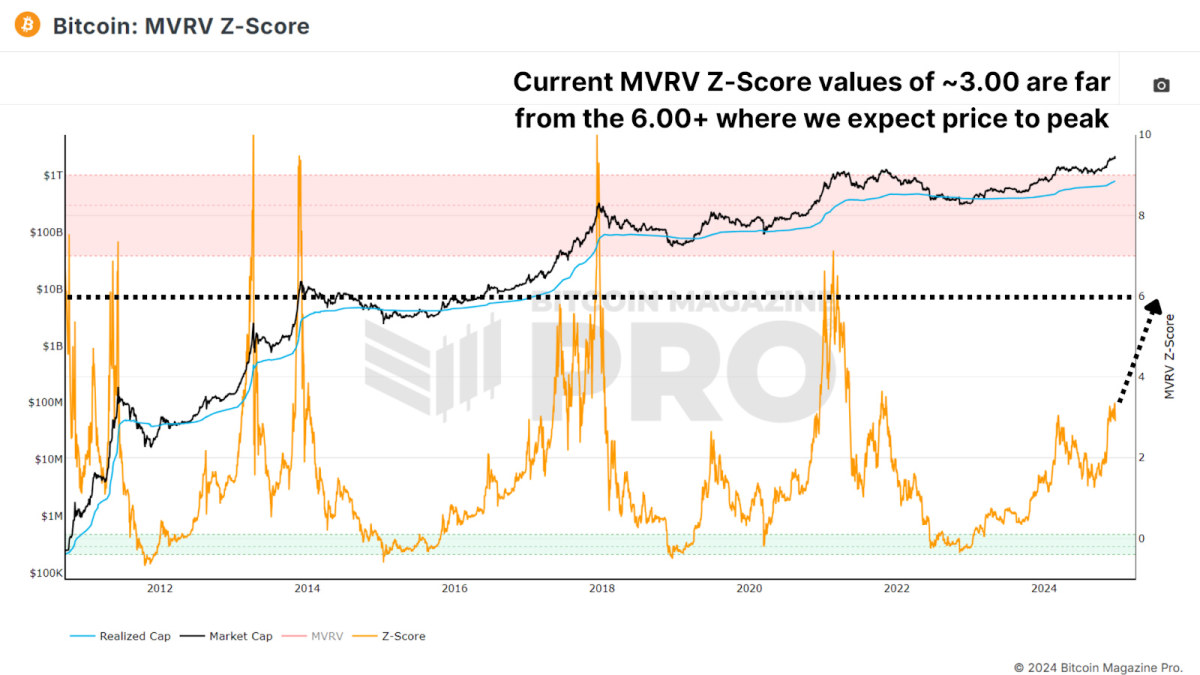

MVRV Z-Score

The MVRV Z-Score measures the market value against the realized value (average cost basis of Bitcoin holders). Standardized into a Z-Score to consider the asset's volatility, it has been effective in identifying cycle peaks and bottoms.

Bitcoin's MVRV Z-Score is currently below the overheated red zone, hovering around 3.00, indicating potential for further growth. Despite recent cycles showing diminishing peaks, the Z-Score suggests that the market is far from reaching an overly optimistic peak.

Active Address Sentiment

This metric monitors the 28-day percentage change in active network addresses alongside the price change during the same period. If price growth outpaces network activity, it suggests a short-term overbought market, indicating that the positive price trend may not be sustainable considering network usage.

Recent data reveals a slight cooldown after Bitcoin's rapid surge from $50,000 to $100,000, indicating a healthy consolidation phase. This pause likely sets the stage for sustained long-term growth, rather than signaling a medium to long-term bearish outlook.

Spent Output Profit Ratio

The Spent Output Profit Ratio (SOPR) quantifies realized profits from Bitcoin transactions. Recent data indicates an increase in profit-taking, hinting at the latter stages of the cycle.

It's essential to consider the rising popularity of Bitcoin ETFs and derivatives, potentially influencing SOPR values as investors shift from self-custody to ETFs for convenience and tax benefits.

Value Days Destroyed

The Value Days Destroyed (VDD) Multiple builds on CDD by emphasizing larger, long-term holders. When this metric enters the overheated red zone, it often signals significant price peaks as prominent market participants start cashing out.

Although Bitcoin's current VDD levels suggest a slightly overheated market, historical data indicates it could sustain this range for months before reaching a peak. For instance, in 2017, VDD pointed towards overbought conditions almost a year before the cycle's peak.

Collectively, these metrics indicate that Bitcoin is in the latter stages of its bull market. While some indicators hint at short-term corrections or minor overextensions, most suggest substantial upside potential throughout 2025. Key resistance levels for this cycle might emerge between $150,000 and $200,000, with metrics like SOPR and VDD offering clearer signals as the peak approaches.

For a more detailed analysis, consider watching a recent YouTube video: What's Happening On-chain: Bitcoin Update.

Frequently Asked Questions

Should You Buy Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The trend for gold prices has been upward in recent years but they still remain low relative to other commodities like silver and oil.

Some experts believe that this could change very soon. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

These are some important things to remember if your goal is to invest in gold.

- Before you start saving money for retirement, think about whether you really need it. You can save for retirement and not invest your savings in gold. However, you can still save for retirement without putting your savings into gold.

- Second, you need to be clear about what you are buying before you decide to buy gold. Each account offers different levels of security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. You may lose your gold coins and never be able to recover them.

Don't buy gold unless you have done your research. Protect your gold if you already have it.

How Much of Your IRA Should Include Precious Metals?

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don't need to be rich to make an investment in precious metals. In fact, there are many ways to make money from gold and silver investments without spending much money.

You might consider purchasing physical coins, such as bullion bars and rounds. Shares in precious metals-producing companies could be an option. Or, you might want to take advantage of an IRA rollover program offered by your retirement plan provider.

Regardless of your choice, you'll still benefit from owning precious metals. Although they aren’t stocks, they offer the possibility for long-term gains.

They also tend to appreciate over time, unlike traditional investments. You'll probably make more money if your investment is sold down the line than traditional investments.

What Precious Metals Can You Invest in for Retirement?

Silver and gold are two of the most valuable precious metals. Both are easy to sell and can be bought easily. You should add them to your portfolio if you are looking to diversify.

Gold: This is the oldest form of currency that man has ever known. It is stable and very secure. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: The popularity of silver has always been a concern for investors. This is a great choice for people who want to avoid volatility. Silver tends to move up, not down, unlike gold.

Platinium: Another form of precious metal is platinum, which is becoming more popular. It is very durable and resistant against corrosion, much like silver and gold. However, it's much more expensive than either of its counterparts.

Rhodium: The catalytic converters use Rhodium. It is also used as a jewelry material. And, it's relatively cheap compared to other types of precious metals.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also less expensive. This is why it has become a favourite among investors looking for precious metals.

How does a gold IRA account work?

Individuals who want to invest with precious metals may use the Gold Ira accounts, which are tax-free.

Physical gold bullion coin can be purchased at any time. To start investing in gold, it doesn't matter if you are retired.

You can keep gold in an IRA forever. You won't have to pay taxes on your gold investments when you die.

Your heirs inherit your gold without paying capital gains taxes. You don't need to include your gold in your final estate report, as it isn't part of the estate.

To open a IRA for gold, you must first create an individual retirement plan (IRA). After you do this, you will be granted an IRA custodian. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reporting.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. Minimum deposit is $1,000 A higher interest rate will be offered if you invest more.

When you withdraw your gold from your IRA, you'll pay taxes on it. If you are withdrawing your entire balance, you will owe income tax plus a 10% penalty.

A small percentage may mean that you don't have to pay taxes. There are some exceptions, though. If you take out 30% of your total IRA assets or more, you will owe federal income taxes and a 20 percent penalty.

You should avoid taking out more than 50% of your total IRA assets yearly. You'll be facing severe financial consequences if you do.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

cftc.gov

investopedia.com

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

How To

Guidelines for Gold Roth IRA

Start saving as soon as possible to save for your retirement. You should start as soon as you are eligible (usually at age 50) and continue saving throughout your career. You must contribute enough each year to ensure that you have adequate growth.

You may also wish to take advantage of tax-free investments such as a SIMPLE IRA, SEP IRA, and traditional 401(k). These savings vehicles allow you to make contributions without paying taxes on earnings until they are withdrawn from the account. They are a great option for those who do not have access to employer matching money.

It's important to save regularly and over time. You may not be eligible for any tax benefits if your contribution is less than the maximum allowed.

—————————————————————————————————————————————————————————————–

By: Matt Crosby

Title: Understanding Bitcoin Market Cycle Through Five On-Chain Indicators

Sourced From: bitcoinmagazine.com/markets/exploring-five-on-chain-indicators-to-understand-the-bitcoin-market-cycle

Published Date: Fri, 20 Dec 2024 13:54:47 GMT