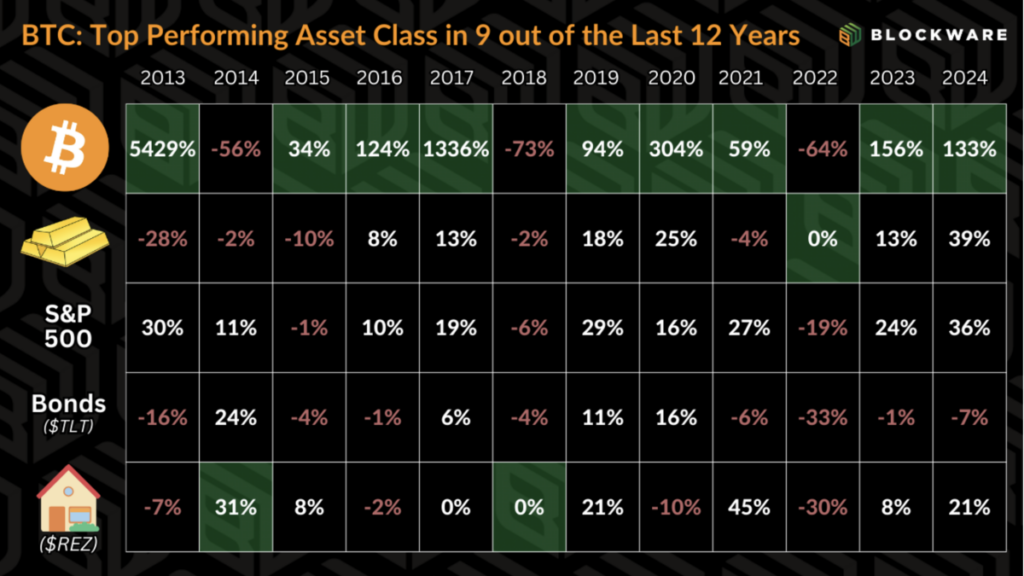

Bitcoin has consistently outperformed all major asset classes over the past decade, solidifying its role as the benchmark for digital asset investors. For those committed to Bitcoin’s long-term vision, the ultimate financial goal often shifts from acquiring more dollars to maximizing their Bitcoin holdings.

Bitcoin as the Foundation of Digital Assets

Bitcoin is to digital assets what treasury bonds are to the legacy financial system—a foundational benchmark. While no investment is without risk, Bitcoin held in self-custody eliminates counterparty risk, dilution risk, and other systemic risks common in traditional finance.

Shifting Financial Objectives

The financial objective of digital asset investors is to acquire more BTC rather than acquire more dollars. All investments or spending are viewed through the lens of BTC being the opportunity cost.

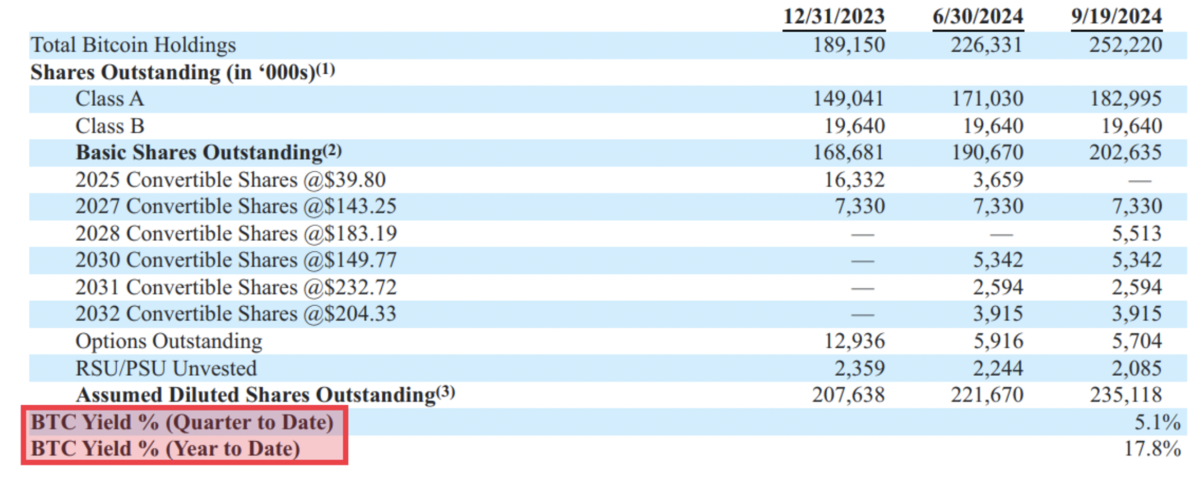

MicroStrategy's BTC Yield KPI

MicroStrategy has demonstrated what this looks like in the corporate world with their new KPI: BTC Yield. MicroStrategy has taken full advantage of the tools available to them as a multi-billion dollar public company.

Maximizing Bitcoin Accumulation

Individual holders are unable to issue shares into the public market in order to raise capital and acquire BTC. So, how can we accumulate more bitcoin? Bitcoin miners acquire BTC by contributing computational power to the Bitcoin network.

Efficiency in Bitcoin Mining

The most effective Bitcoin miners are those that maximize their computational power while minimizing their operational costs. Under current market conditions, Bitcoin miners need to operate with the lowest possible electricity rate to maximize their profits.

Price Dynamics in Bitcoin Mining

The price of a financial asset, like bitcoin, is set at the margin. This means that the asset’s price is determined by the most recent transactions between buyers and sellers, leading to BTC’s notoriously volatile price action.

Opportunities for Bitcoin Miners

Price volatility in Bitcoin mining hardware and wider profit margins during bull markets create opportunities for Bitcoin miners to accumulate vast amounts of bitcoin. Bitcoin mining hardware retaining resale value is becoming increasingly the case with each new generation of hardware.

Blockware Marketplace for Bitcoin Mining

Blockware developed this platform to enable any investor – institutional or retail – the opportunity to gain direct exposure to Bitcoin mining. This innovation removes the obstacles that have historically made hosted mining difficult, enabling miners to concentrate on the mission: accumulating more Bitcoin.

Frequently Asked Questions

How to open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. You must complete Form 8606 to open an account. For you to determine the type and eligibility for which IRA, you need Form 5204. This form should not be completed more than 60 days after the account is opened. Once this is done, you can start investing. You might also be able to contribute directly from the paycheck through payroll deduction.

For a Roth IRA you will need to complete Form 8903. The process for an ordinary IRA will not be affected.

To be eligible for a precious metals IRA, you will need to meet certain requirements. The IRS says you must be 18 years old and have earned income. Your earnings cannot exceed $110,000 per year ($220,000 if married and filing jointly) for any single tax year. Additionally, you must make regular contributions. These rules apply to contributions made directly or through employer sponsorship.

You can use a precious metals IRA to invest in gold, silver, palladium, platinum, rhodium, or even platinum. You can only purchase bullion in physical form. This means you can't trade shares of stock and bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. This option is offered by some IRA providers.

However, there are two significant drawbacks to investing in precious metals via an IRA. They aren't as liquid as bonds or stocks. They are therefore more difficult to sell when necessary. Second, they don’t produce dividends like stocks or bonds. Therefore, you will lose more money than you gain over time.

Who holds the gold in a gold IRA?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

To take advantage of this tax-free status, you must own at least $10,000 worth of gold and have been storing it for at least five years.

The purchase of gold can protect you from inflation and price volatility. But it's not smart to hold it if your only intention is to use it.

If you plan to sell the gold one day, you will need to report its worth. This will affect how much capital gains tax you owe on cash you have invested.

A financial planner or accountant should be consulted to discuss your options.

How is gold taxed in Roth IRA?

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

You don't pay tax if you have the money in a traditional IRA/401k. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

The rules that govern these accounts differ from one state to the next. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you to wait until April 1. New York is open until 70 1/2. You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

How does a Gold IRA account work?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase physical gold bullion coins anytime. You don't have a retirement date to invest in gold.

Owning gold as an IRA has the advantage of allowing you to keep it forever. Your gold assets will not be subjected tax upon your death.

Your gold is passed to your heirs without capital gains tax. Because your gold doesn't belong to the estate, it's not necessary to include it on your final estate plan.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). After you have done this, an IRA custodian will be assigned to you. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reporting.

After you have established your gold IRA you will be able purchase gold bullion coin. Minimum deposit required is $1,000 However, you'll receive a higher interest rate if you put in more.

Taxes will apply to gold that you take out of an IRA. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

Even if your contribution is small, you might not have to pay any taxes. There are exceptions. For example, taking out 30% or more of your total IRA assets, you'll owe federal income taxes plus a 20 percent penalty.

You shouldn't take out more then 50% of your total IRA assets annually. Otherwise, you'll face steep financial consequences.

Is the government allowed to take your gold

Because you have it, the government can't take it. It is yours because you worked hard for it. It belongs exclusively to you. This rule could be broken by exceptions. You could lose your gold if convicted of fraud against a federal government agency. Your precious metals can also be lost if you owe tax to the IRS. However, even if taxes are not paid, gold is still your property.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement accounts

finance.yahoo.com

irs.gov

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

The History of Gold as an Asset

Gold was a currency from ancient times until the early 20th century. It was universally accepted due to its purity and divisibility, beauty, scarcity, and durability. It was also traded internationally due to its high value. There was no international standard for measuring gold at that time, so different weights and measures were used around the world. One pound sterling in England was equivalent to 24 carats silver, while one livre tournois in France was equal 25 carats. In Germany, one mark was equivalent to 28 carats.

In the 1860s, the United States began issuing American coins made up of 90% copper, 10% zinc, and 0.942 fine gold. The result was a decrease in foreign currency demand, which led to an increase in their price. The United States began minting large quantities gold coins at this time, which led to a drop in the price. The U.S. government was unable to pay its debts due to too much money being in circulation. To do so, they decided to sell some of the excess gold back to Europe.

Many European countries began accepting gold in exchange for the dollar because they did not trust it. After World War I, however, many European countries started using paper money to replace gold. The value of gold has significantly increased since then. Although the price of gold fluctuates today, it remains one of your most safe investments.

—————————————————————————————————————————————————————————————–

By: Blockware

Title: How Bitcoin Miners Maximize Accumulation of BTC

Sourced From: bitcoinmagazine.com/guides/maximizing-bitcoin-accumulation-beyond-the-benchmark-

Published Date: Tue, 26 Nov 2024 21:52:20 GMT