Potential for a Price Rise

Bitcoin has experienced a remarkable surge of over 150% in 2023, captivating the attention of Wall Street. This has sparked a race among firms to launch the first-ever Bitcoin exchange-traded fund (ETF). All eyes are now on the upcoming decision by the U.S. Securities and Exchange Commission (SEC) regarding the approval of a spot Bitcoin ETF, scheduled for January 10.

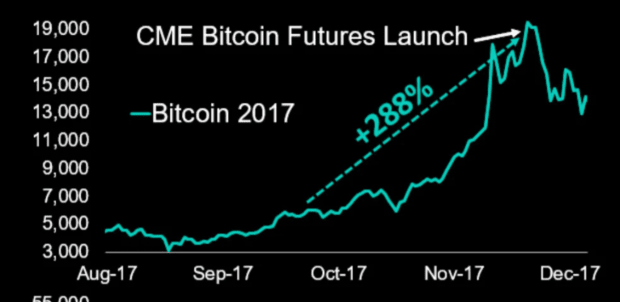

If history is any indication, the SEC's ruling will have a significant impact on Bitcoin's price. Proponents of a Bitcoin ETF argue that its approval would open the floodgates for institutional and retail investments, driving the price of Bitcoin to new heights. In the past, expectations surrounding ETFs have influenced Bitcoin's price. For instance, in 2017, the anticipation of the first Bitcoin ETF caused the price to surge to over $1,400 from lows in the $600 range the previous year. However, the SEC ultimately rejected the proposal, resulting in a sharp decline in Bitcoin's price, which dipped below $1,000.

On the other hand, in 2021, the successful launch of Bitcoin futures ETFs in Canada and Europe played a role in driving Bitcoin to all-time highs of over $60,000. The expectation of a similar product in the U.S. contributed to the bullish sentiment. Furthermore, earlier this year, the fake news of an ETF approval caused Bitcoin's price to rise by several thousand dollars in minutes, indicating that approval could lead to significant upside volatility.

Potential for a Price Fall

However, there are arguments suggesting that the approval of a Bitcoin ETF could also lead to a price correction. Some market experts express concerns that the ETF could become a target for short sellers, resulting in increased volatility. There is also the possibility of a "sell the news event," where the approval of the ETF leads to a sell-off. Additionally, the approval of a Bitcoin ETF may invite greater regulatory scrutiny, potentially leading to increased taxation, reporting requirements, and restrictions on the use of Bitcoin. These factors could dampen enthusiasm among investors.

Furthermore, some believe that the market may have already priced in the possibility of a Bitcoin ETF approval. If the decision is to deny approval, it could lead to disappointment and a sell-off similar to what was witnessed in 2017 when the Winklevoss Bitcoin ETF was rejected.

Considerations and Conclusion

While the final decision by the SEC is eagerly awaited by the crypto community, it is important to remember that it is just one of many factors influencing Bitcoin's price. Market sentiment, macroeconomic conditions, and geopolitical events will also play their part in shaping the future of the coin.

In conclusion, Bitcoin's price is at a crossroads as investors anxiously await the SEC's decision on the Bitcoin ETF. While past instances have shown that ETF expectations can have a substantial impact on Bitcoin's price, it is crucial to consider the broader market dynamics. The outcome of the SEC ruling will depend on various factors, including market interpretation and reaction. As the crypto world holds its breath, the future of Bitcoin remains uncertain, but this moment undoubtedly marks a pivotal juncture for the world's only decentralized cryptocurrency.

Frequently Asked Questions

Who holds the gold in a gold IRA?

The IRS considers gold owned by an individual to be “a type of money” and is subject taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

To find out what options you have, consult an accountant or financial planner.

What is the best precious-metal to invest?

This depends on what risk you are willing take and what kind of return you desire. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. Gold may not be right for you if you want quick profits. If you have the patience to wait, then you might consider investing in silver.

If you don’t want to be rich fast, gold might be the right choice. Silver may be a better option for investors who want long-term steady returns.

Can I keep a Gold ETF in a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

Traditional IRAs allow for contributions from both employees and employers. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

You can also get an Individual Retirement Annuity, or IRA. With an IRA, you make regular payments to yourself throughout your lifetime and receive income during retirement. Contributions to IRAs can be made without tax.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Do you want to keep your IRA gold at home? It's not exactly legal – WSJ

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Three Ways to Invest In Gold For Retirement

It is important to understand the role of gold in your retirement plan. You can invest in gold through your 401(k), if you have one at work. You might also be interested to invest in gold outside the workplace. If you have an IRA (Individual Retirement Account), a custodial account could be opened at Fidelity Investments. You might also consider purchasing precious metals directly from a trusted dealer if they are not already yours.

These are the rules for gold investing:

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, cash in your accounts. This will protect you from inflation and help keep your purchasing power high.

- Own Physical Gold Coins – You should buy physical gold coins rather than just owning a paper certificate. Physical gold coins are easier to sell than certificates. Physical gold coins don't require storage fees.

- Diversify Your Portfolio – Never put all of your eggs in one basket. This is how you spread your wealth. You can invest in different assets. This helps reduce risk and gives you more flexibility during market volatility.

—————————————————————————————————————————————————————————————–

By: Reed Macdonald

Title: The Impact of a Bitcoin ETF on Bitcoin's Price: What to Expect

Sourced From: bitcoinmagazine.com/markets/why-the-bitcoin-price-will-rise-or-fall-on-the-secs-spot-etf-ruling

Published Date: Tue, 02 Jan 2024 13:49:59 GMT