The United States federal government has recently increased its Bitcoin holdings by transferring $922 million from wallets linked to Bitfinex hackers in a seizure.

The Rise of the US Government as a Major Bitcoin Holder

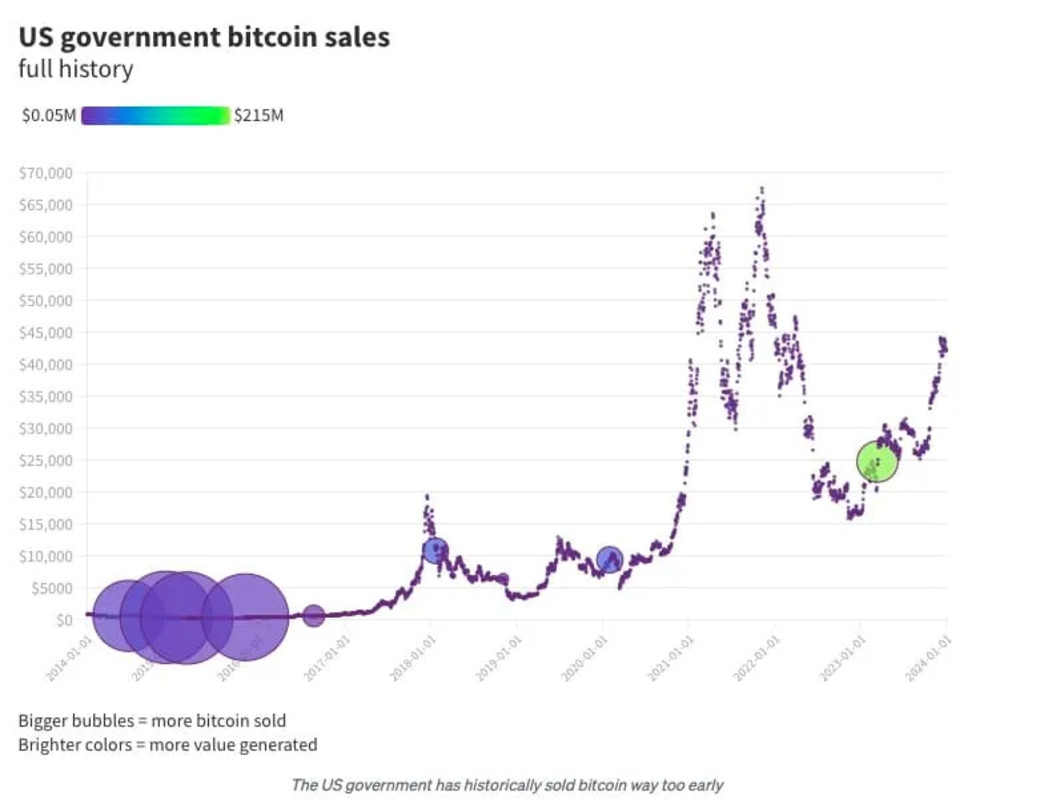

Through a series of seizures and asset forfeitures, the US federal government has amassed a significant amount of Bitcoin, solidifying its position as one of the largest whales in the crypto space. In the early days of Bitcoin, a crypto-anarchist ethos prevailed, leading to various extralegal activities, notably the Silk Road. Although the illicit era has largely ended, the success of these ventures resulted in the accumulation of substantial amounts of Bitcoin, much of which is now held by the US government.

Seizures Linked to Silk Road and Bitfinex Hackers

The Silk Road has been a focal point for law enforcement seizures, with assets seized not only from the site but also from hackers involved in its operations. Recently, hackers Ilya Lichtenstein and Heather "Razzlekhan" Morgan had over 15k bitcoins seized by the government. Their 2016 hack of Bitfinex remains one of the most lucrative heists, impacting the exchange's operations to this day.

Government's Bitcoin Holdings and Transparency

Analysts estimate that the US government holds close to 200k bitcoins, valued at around $12.1 billion, making it a significant player in the crypto market. With approximately 1% of all Bitcoin in circulation, the government wields considerable influence. Despite claims of non-profit maximization in asset disposal, its leverage in the space is undeniable.

Edward Snowden's Insights and Global Bitcoin Acceptance

Whistleblower Edward Snowden's comments on governments secretly acquiring Bitcoin amid its growing acceptance in global finance are thought-provoking. While nations like El Salvador openly embrace Bitcoin, the US government's silent accumulation raises questions about its intentions.

Transparency Challenges and Speculation on Government Buyers

The trustless nature of Bitcoin's blockchain poses transparency challenges for governments looking to acquire significant amounts covertly. Recent purchases by an anonymous entity, "Mr. 100," have sparked speculation of national government involvement, with Asian countries like Qatar and Saudi Arabia being potential candidates.

Building Bitcoin Reserves through Seizures

Governments may find it more feasible to seize Bitcoin assets rather than purchase them outright to avoid scrutiny. The UK's seizure of $1.77 billion in January underscores this approach, signaling a potential trend in accumulating cryptocurrency reserves through legal means.

The Legitimization of Bitcoin and Government Reserves

As Bitcoin gains mainstream acceptance, governments worldwide are recognizing the need to maintain reserves of the digital currency. With the US leading the way in Bitcoin ownership, other nations are likely to follow suit to stay competitive in the evolving financial landscape.

In conclusion, while the race to build Bitcoin reserves continues, the impact of government involvement on the crypto market remains a pivotal development to watch.

Frequently Asked Questions

Should you Invest In Gold For Retirement?

It depends on how much you have saved and if gold was available at the time you started saving. If you are unsure of which option to invest in, consider both.

Gold offers potential returns and is therefore a safe investment. Retirement investors will find gold a worthy investment.

Although most investments promise a fixed rate of return, gold is more volatile than others. As a result, its value changes over time.

However, it doesn't necessarily mean that you shouldn't invest your money in gold. It just means that you need to factor in fluctuations to your overall portfolio.

Another benefit to gold? It's a tangible asset. Unlike stocks and bonds, gold is easier to store. It's also portable.

You can always access your gold as long as it is kept safe. Physical gold is not subject to storage fees.

Investing in gold can help protect against inflation. Gold prices are likely to rise with other commodities so it is a good way of protecting against rising costs.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold usually rises when stocks fall.

Investing in gold has another advantage: you can sell it anytime you want. Just like stocks, you can liquidate your position whenever you need cash. You don't have to wait for retirement.

If you do decide to invest in gold, make sure to diversify your holdings. Don't place all your eggs in the same basket.

Do not buy too much at one time. Start by purchasing a few ounces. Next, add more as required.

It's not about getting rich fast. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Can I own a gold ETF inside a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

Traditional IRAs allow for contributions from both employees and employers. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money invested in ESOPs is taxed at a lower rate that if it were owned directly by an employee.

An Individual Retirement Annuity (IRA) is also available. With an IRA, you make regular payments to yourself throughout your lifetime and receive income during retirement. Contributions to IRAs do not have to be taxable

Are gold investments a good idea for an IRA?

Gold is an excellent investment for any person who wants to save money. It's also a great way to diversify your portfolio. There's more to gold that meets the eye.

It's been used as a form of payment throughout history. It's often referred to as “the world's oldest currency.”

Gold is not created by governments, but it is extracted from the earth. That makes it very valuable because it's rare and hard to create.

The supply and demand for gold determine the price of gold. The economy that is strong tends to be more affluent, which means there are less gold miners. The value of gold rises as a consequence.

On the flipside, people may save cash rather than spend it when the economy slows. This increases the production of gold, which in turn drives down its value.

This is why gold investment makes sense for both individuals and businesses. If you invest in gold, you'll benefit whenever the economy grows.

You'll also earn interest on your investments, which helps you grow your wealth. If gold's value falls, you don't have to lose any of your investments.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

cftc.gov

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

How To

Three ways to invest in gold for retirement

It's crucial to understand where gold fits in your retirement strategy. You can invest in gold through your 401(k), if you have one at work. You may also be interested in investing in gold beyond your workplace. For example, if you own an IRA (Individual Retirement Account), you could open a custodial account at a brokerage firm such as Fidelity Investments. If precious metals aren't your thing, you may be interested in buying them from a dealer.

These are three simple rules to help you make an investment in gold.

- Buy Gold With Your Cash – Do not use credit cards to purchase gold. Instead, deposit cash into your accounts. This will help protect you against inflation and keep your purchasing power high.

- Own Physical Gold Coins – You should buy physical gold coins rather than just owning a paper certificate. Physical gold coins can be sold much faster than paper certificates. You don't have to store physical gold coins.

- Diversify Your Portfolio. Never place all your eggs in the same basket. This is how you spread your wealth. You can invest in different assets. This reduces risk and allows you to be more flexible during market volatility.

—————————————————————————————————————————————————————————————–

By: Landon Manning

Title: The United States Government's Growing Bitcoin Hoard: A Closer Look

Sourced From: bitcoinmagazine.com/markets/us-government-continues-bitcoin-seizures-controls-nearly-1-of-circulating-supply-

Published Date: Mon, 04 Mar 2024 14:15:46 GMT

Related posts:

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

Satsback Launches Bitcoin Back Rewards Platform for Online Shoppers in the United States

Satsback Launches Bitcoin Back Rewards Platform for Online Shoppers in the United States

Report: Financial Services Giant Old Mutual Appointed Manager of South African Stablecoin Project’s Cash Reserves

Report: Financial Services Giant Old Mutual Appointed Manager of South African Stablecoin Project’s Cash Reserves

Is The President Of El Salvador Acting Like An Authoritarian?

Is The President Of El Salvador Acting Like An Authoritarian?