Grayscale's spot bitcoin exchange-traded fund (ETF), known as GBTC, has experienced increased outflows since its recent update. Present data reveals that a substantial 14,292.18 bitcoin, valued slightly above $556 million, exited the fund after Monday's trading activities.

Declining Holdings Highlight Largest Outflow to Date

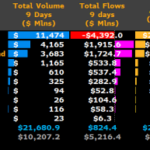

Recent figures indicate a notable decrease in Grayscale's spot bitcoin ETF holdings, declining from 566,973.40 BTC on Friday to 552,681.22 BTC currently. This reduction highlights that the fund's most recent outflow is its largest to date, with 14,292.18 BTC, equivalent to $556 million, departing from the trust. Since Jan. 12, 2024, GBTC has seen its reserves diminish from 617,079.99 BTC to its present level, a loss of roughly 64,398.77 BTC, now valued at just over $2.5 billion.

Increased Holdings for Blackrock's IBIT and Fidelity's Wise Origin ETFs

On Jan. 22, the trade volumes for spot bitcoin ETFs reached $2.09 billion, with GBTC volume contributing $1.08 billion to this total. The latest figures reveal that Blackrock's IBIT spot bitcoin exchange-traded fund (ETF) has experienced a notable uptick in its holdings, currently possessing 39,925.37 BTC as of Jan. 22, 2024. In a similar vein, Fidelity's Wise Origin spot bitcoin ETF, known as FBTC, now boasts a holding of 30,169.54 BTC.

Discussion and Analysis of Outflows and Market Downturn

Grayscale's outflows and the declining value of bitcoin have sparked widespread discussion on social media platforms. Bitcoin's price has slid below the $39K threshold. Etoro's market strategist, Simon Peters, commented on Monday morning that a portion of GBTC's outflows can be attributed to investors migrating towards options with "lower fee alternatives." Concurrently, xs.com's market analyst, Antonio Ernesto Di Giacomo, pointed to bitcoin miner outflows as contributing to the downturn.

In a note sent to Bitcoin.com News, Blockguard CEO Anthony Bevan emphasized that retail investors should remain calm during the correction. "Retail investors need to be aware that large players in the market will always try to manipulate prices, this is done to flush out sellers' lower price, and more often than not the big player will buy back in," Bevan explained. "The important thing you is to stay calm and where possible DCA (dollar-cost-average) into your investment."

Bevan additionally emphasized that predicting the duration of this downturn is an uncertainty. "However in my opinion, we will see a strong wick down to liquidate longs with bounce and slight recovery so that we find a range again, once we find a new range, we will have a better idea of where the market would go next," the Blockguard executive added. Over the last 24 hours, coinglass.com metrics show $91.92 million in bitcoin long positions have been liquidated.

What do you think about the GBTC outflows and bitcoin's price sinking below $39K? Let us know what you think about this subject in the comments section below.

Frequently Asked Questions

How Does Gold Perform as an Investment?

The price of gold fluctuates based on supply and demand. It is also affected by interest rates.

Due to their limited supply, gold prices fluctuate. Additionally, physical gold can be volatile because it must be stored somewhere.

What precious metals do you have that you can invest in for your retirement?

It is gold and silver that are the best precious metal investment. Both are easy to sell and can be bought easily. You should add them to your portfolio if you are looking to diversify.

Gold: The oldest form of currency known to man is gold. It is also extremely safe and stable. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: The popularity of silver has always been a concern for investors. This is a great choice for people who want to avoid volatility. Silver is more volatile than gold. It tends to rise rather than fall.

Platinium is another precious metal that is becoming increasingly popular. It's resistant to corrosion and durable, similar to gold and silver. It is however more expensive than its counterparts.

Rhodium. Rhodium is used as a catalyst. It is also used to make jewelry. It is also quite affordable compared with other types of precious metals.

Palladium: Palladium has a similarity to platinum but is more rare. It's also much more affordable. Investors looking to add precious and rare metals to their portfolios love it for these reasons.

How much is gold taxed under a Roth IRA

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

Each state has its own rules regarding these accounts. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. Massachusetts allows you up to April 1st. And in New York, you have until age 70 1/2 . To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

What are the advantages of a gold IRA

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It is tax-deferred until it's withdrawn. You can decide how much money you withdraw each year. There are many types and types of IRAs. Some are more suitable for students who wish to save money for college. Others are intended for investors seeking higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. However, once they begin withdrawing funds, these earnings are not taxed again. This type account may make sense if it is your intention to retire early.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

You can also enjoy automatic withdrawals, which is another benefit of owning your gold through an IRA. You won't have the hassle of making deposits each month. To make sure you don't miss any payments, you can also set up direct deductions.

Finally, gold is one the most secure investment options available. Because it isn’t tied to any specific country, gold’s value tends to stay stable. Even during economic turmoil the gold price tends to remain fairly stable. This makes it a great investment option to protect your savings from inflation.

How much gold do you need in your portfolio?

The amount of capital required will affect the amount you make. You can start small by investing $5k-10k. As you grow, you can move into an office and rent out desks. You don't need to worry about paying rent every month. Rent is only paid per month.

You also need to consider what type of business you will run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. This means that you may only be paid once every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k-$2k of gold and growing from there.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

cftc.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

Guidelines for Gold Roth IRA

Start saving as soon as possible to save for your retirement. As soon as you become eligible, which is usually around age 50, start saving and keep it up throughout your career. It is important to invest enough money each and every year to ensure you get adequate growth.

You may also wish to take advantage of tax-free investments such as a SIMPLE IRA, SEP IRA, and traditional 401(k). These savings vehicles allow you to make contributions without paying taxes on earnings until they are withdrawn from the account. These savings vehicles can be a great option for individuals who don't qualify for employer matching funds.

It is important to save consistently over time. If you aren't contributing the maximum amount permitted, you could miss out on tax benefits.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Grayscale's Bitcoin ETF Sees Significant Outflows as Holdings Decline

Sourced From: news.bitcoin.com/gbtc-experiences-record-bitcoin-outflow-blockguard-ceo-advises-investor-calm-amidst-market-shift/

Published Date: Tue, 23 Jan 2024 16:00:43 +0000

Related posts:

Forecasting Total Bitcoin Selling Pressure & Market Impact: GBTC Outflows

Forecasting Total Bitcoin Selling Pressure & Market Impact: GBTC Outflows

Grayscale’s GBTC Sees a Significant Decrease in Bitcoin Holdings Amid Growing Bitcoin ETF Competition

Grayscale’s GBTC Sees a Significant Decrease in Bitcoin Holdings Amid Growing Bitcoin ETF Competition

BlackRock’s Spot Bitcoin ETF Volume Outpacing GBTC Today, Indicating Market Shift

BlackRock’s Spot Bitcoin ETF Volume Outpacing GBTC Today, Indicating Market Shift

GBTC: Market Share in ETF Trade Volume Drops as $2 Billion BTC Exodus Occurs

GBTC: Market Share in ETF Trade Volume Drops as $2 Billion BTC Exodus Occurs