NFT Market Faces Sharp Decline

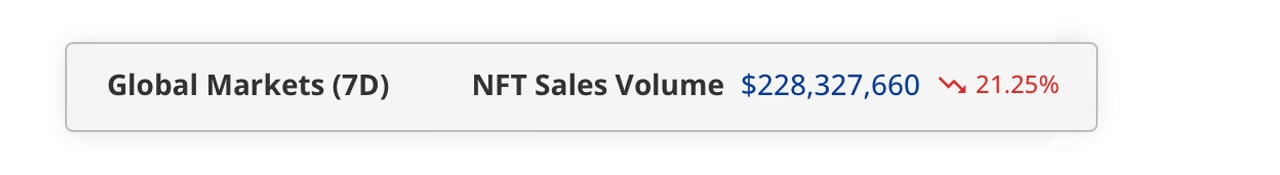

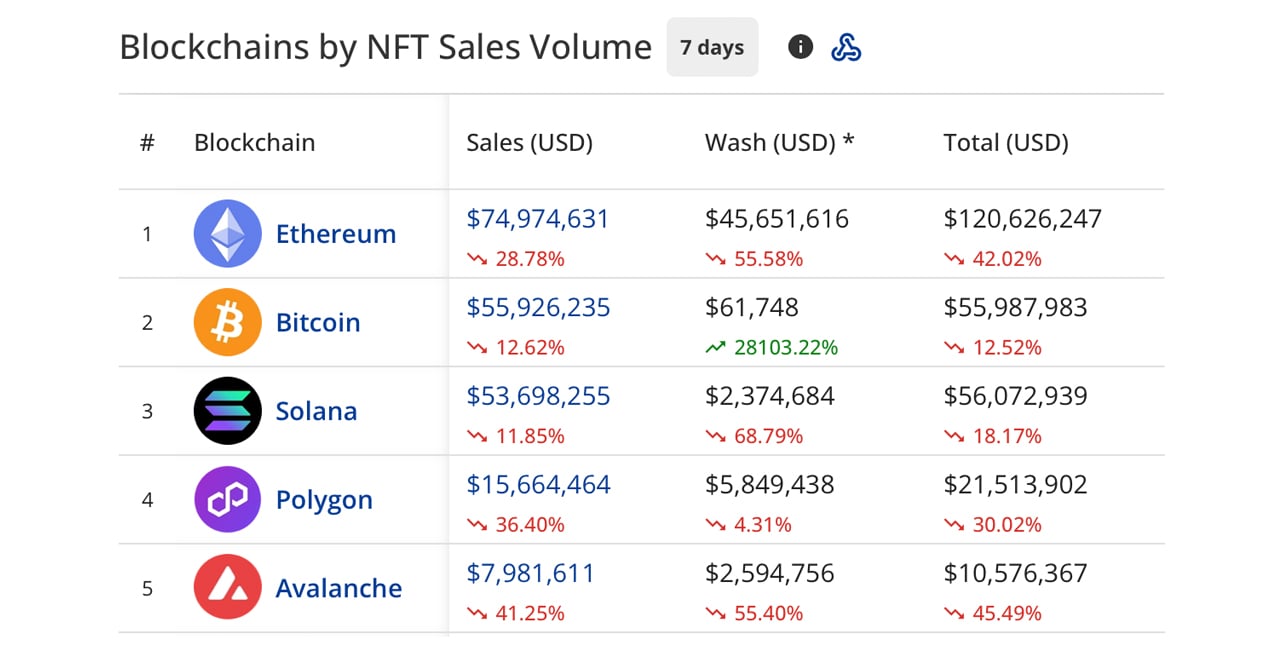

The week of January 20 to January 27, 2024, witnessed a significant decline in the sales volume of non-fungible tokens (NFTs), with a plunge of 21.25% compared to the previous week. The leading blockchains in terms of seven-day sales, Ethereum and Bitcoin, experienced substantial decreases of 28.78% and 12.62%, respectively.

At the beginning of 2024, NFT sales saw a dip of 1.31% compared to the figures from the previous week in 2023. The following week saw a marginal rise of approximately 0.05% in NFT sales, but the last week experienced a significant drop of 5.05% in digital collectible sales.

This week marked the steepest decline in 2024, with sales plummeting over 21% compared to the previous seven days. According to metrics from cryptoslam.io, the total sales volume amounted to $228,327,660.

Meanwhile, Bitcoin experienced a 12.62% week-over-week drop, with $55.92 million in sales over the same seven-day period. Solana secured the third rank, recording $53.69 million in sales, which is a decrease of 11.85%.

Polygon's NFT sales claimed the fourth position, amounting to $15.66 million, yet experienced a significant drop of 36.40%. In the fifth spot, Avalanche garnered $7.98 million in sales, with a notable decline of 41.25% in its NFT market.

All five of the top blockchains leading the week's sales saw double-digit losses. Among the top ten this week, Ronin, notably the blockchain supporting Axie Infinity, witnessed a significant surge of 209.09%, achieving $1.76 million in NFT sales.

High-Ranking NFT Collections and Top Sales

In the realm of unique digital collectible collections, the Cryptopunks series clinched the highest position in sales this week. Cryptopunks amassed $13.67 million in sales during the past seven days, marking an increase of 32.23% from the previous week.

Bitcoin's Uncategorized Ordinals experienced $9 million in sales, witnessing a 3.75% decline from the week prior. In the third spot, Solana's Froganas reported $7.04 million in sales, a significant increase of 420.77% compared to last week.

Occupying the fourth rank, Solana's Cryptoundeads achieved $6.75 million in sales but faced a 58.82% decrease. In the fifth position, Avalanche's Dokyo NFT collection registered $5.85 million in sales, experiencing a 33.70% drop in sales volume from the previous week.

The highest-priced digital collectible of the past week was Cryptopunk #6,940, which fetched $507,618 seven days ago. BNB's Lockdealnft #18,858 realized a sale of $147,157 four days ago, while an Axie Infinity NFT commanded a price of $143,559 this week.

An Uncategorized Ordinal was acquired for $88,386, and Cardano's Meld Diamond Hand #2,813 went for $56,186. The sales of Cryptopunk #6,940 and the Axie Infinity NFT contributed significantly to the sales boost on their respective chains.

Sales of blockchain-based digital collectibles faced a challenging period throughout 2022, and most of 2023 also witnessed a downturn in NFT sales until the end of the year. Bitcoin's entry into the NFT sales arena initially boosted overall sales, but BTC-focused NFT sales not only decreased this week but also experienced a 28.15% drop the week before.

NFTs based on Solana and Polygon showed an increase in the latter part of 2023, yet they have recently encountered modest falls in their overall digital collectible sales volume. Whether this downward trend in NFT sales continues or a resurgence occurs remains to be seen.

What are your thoughts on this week's NFT sales action? Share your opinions in the comments section below.

Frequently Asked Questions

What does gold do as an investment?

Supply and demand determine the gold price. Interest rates also have an impact on the price of gold.

Because of their limited supply, gold prices can fluctuate. Additionally, physical gold can be volatile because it must be stored somewhere.

How do you withdraw from an IRA that holds precious metals?

First, decide if it is possible to withdraw funds from an IRA. You should also ensure that you have enough money to cover any fees and penalties associated with withdrawing funds.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, determine how much money you plan to withdraw from your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

Once these calculations have been completed you will need to open an account with a brokerage. To encourage customers to open accounts, brokers often offer signup bonuses and promotions. You can save money by opening an account with a debit card instead of a credit card to avoid paying unnecessary fees.

When it's time to make withdrawals from your precious-metal IRA, you'll need a place to keep your coins safe. Some storage facilities will take bullion bars while others require you only to purchase individual coins. You will need to weigh each one before making a decision.

Bullion bars require less space, as they don't contain individual coins. However, you'll need to count every coin individually. On the flip side, storing individual coins allows you to easily track their value.

Some people prefer to keep their coins in a vault. Some prefer to keep them in a vault. You can still enjoy the benefits of bullion for many years, regardless of which method you choose.

How to Open a Precious Metal IRA

First, you must decide if your Individual Retirement Account (IRA) is what you want. You must complete Form 8606 to open an account. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. This form should be filled within 60 calendar days of opening the account. You can then start investing once you have this completed. You might also be able to contribute directly from the paycheck through payroll deduction.

You must complete Form 8903 if you choose a Roth IRA. Otherwise, the process will be identical to an ordinary IRA.

You'll need to meet specific requirements to qualify for a precious metals IRA. The IRS stipulates that you must have earned income and be at least 18-years old. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Contributions must be made regularly. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

An IRA for precious metals allows you to invest in gold and silver as well as platinum, rhodium, and even platinum. However, you can't purchase physical bullion. This means you can't trade shares of stock and bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option is available from some IRA providers.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. First, they are not as liquid or as easy to sell as stocks and bonds. This makes them harder to sell when needed. They don't yield dividends like bonds and stocks. Therefore, you will lose money over time and not gain it.

What precious metals can you invest in for retirement?

Gold and silver are the best precious metal investments. Both are easy to sell and can be bought easily. You should add them to your portfolio if you are looking to diversify.

Gold: Gold is one of man's oldest forms of currency. It's stable and safe. It is a good way for wealth preservation during uncertain times.

Silver: Silver has always been popular among investors. This is a great choice for people who want to avoid volatility. Silver tends to move up, not down, unlike gold.

Platinum: This precious metal is also becoming more popular. It's resistant to corrosion and durable, similar to gold and silver. However, it's much more expensive than either of its counterparts.

Rhodium. Rhodium is used as a catalyst. It's also used in jewelry making. It is also quite affordable compared with other types of precious metals.

Palladium: Palladium has a similarity to platinum but is more rare. It's also much more affordable. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

Can I have a gold ETF in a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

An IRA traditional allows both employees and employers to contribute. An Employee Stock Ownership Plan (ESOP) is another way to invest in publicly traded companies.

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

An Individual Retirement Annuity (IRA) is also available. An IRA allows you to make regular payments throughout your life and earn income in retirement. Contributions to IRAs don't have to be taxable

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement account

finance.yahoo.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

How To

How to hold physical gold in an IRA

The best way to invest in Gold is by purchasing shares of companies that produce it. But this investment method has many risks as there is no guarantee of survival. There is always the chance of them losing their money due to fluctuations of the gold price.

Another option is to purchase physical gold. This requires you to either open up your account at a bank or an online bullion dealer or simply purchase gold from a reputable seller. These options offer the convenience of easy access, as you don't need stock exchanges to do so. You can also make purchases at lower prices. It's easier to track how much gold is in your possession. The receipt will show exactly what you paid. You'll also know if taxes were not paid. There's also less chance of theft than investing in stocks.

There are also some drawbacks. You won't be able to benefit from investment funds or interest rates offered by banks. You can't diversify your holdings, and you are stuck with the items you have bought. Finally, the taxman may ask you about where you have put your gold.

BullionVault.com is the best website to learn about gold purchases in an IRA.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: 2024 Sees Steepest Weekly Plunge in NFT Sales, 5 Major Blockchains Register Double-Digit Losses

Sourced From: news.bitcoin.com/2024-sees-steepest-weekly-plunge-in-nft-sales-5-major-blockchains-register-double-digit-losses/

Published Date: Sun, 28 Jan 2024 19:00:53 +0000