NFT Sales Surge: Bitcoin Holds Top Spot With Unprecedented December Rise

In November, Bitcoin secured the leading position in monthly non-fungible token (NFT) sales. Surprisingly, Bitcoin continued to maintain its top status in December, accumulating a staggering $853 million in sales.

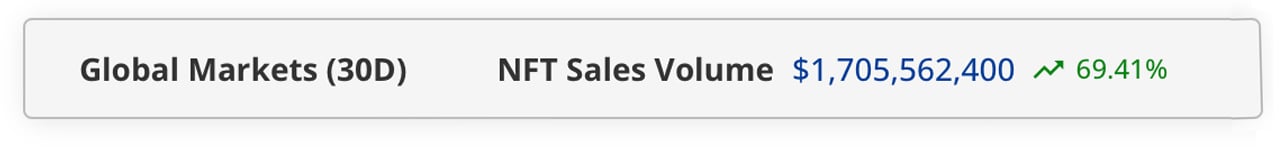

Although NFT sales have decreased by over 35% in the past week compared to the previous week, December witnessed a historic $1.7 billion in NFT transactions. This represents a remarkable increase of more than 69% compared to November's figures. Bitcoin remains the dominant force in NFT sales across various blockchains. In fact, BTC-based NFT sales surged 127.63% higher than November's totals, as reported by cryptoslam.io.

Bitcoin Leads the Way in NFT Sales

In December, Bitcoin's NFT sales reached an impressive $853 million, surpassing Ethereum's NFT sales which totaled $364.79 million. BTC-focused NFT sales outperformed ETH's by 2.34 times. Solana secured the third spot with approximately $325.14 million in NFT sales, experiencing a 312% increase from November's Solana-centric NFT figures. Following closely behind were Polygon and Arbitrum, emerging as leading blockchains in NFT sales.

The most valuable NFT transaction in December featured a digital copy of Vincent Van Gogh's Self-portrait, 1888 (Van Gogh's painting #216), which fetched an impressive price of $1.19 million. Ethereum hosted the sale of Frxethredemption Ticket #33, generating $638,433 in revenue. Additionally, Cardano's Deep Vision #05128 sold for $551,750, while BNB's Lockdealnft #91 garnered $329,824. Completing the list of December's top five highest-priced NFTs was Solana's Boogle #009, which was sold for $274,209.

Bitcoin Dominates the NFT Market

Out of the top ten NFT collections in terms of sales, seven of them are based on the Bitcoin blockchain. Solana's Tensorians claimed the fifth spot, while the Mad Lads collection secured the eighth position. Arbitrum's Sentry Node collection ranked ninth. In December, there were a total of 11,290,812 NFT transactions involving 469,389 sellers and 600,744 NFT buyers.

The Future of Bitcoin in the NFT Market

As Bitcoin continues to dominate NFT sales in November and December, the crypto community eagerly awaits to see if this trend will sustain or if it is just a momentary period of dominance in the NFT world. Only time will tell if Bitcoin can maintain its lead or if the dynamics of NFT sales in the blockchain world will shift.

What are your thoughts on NFT sales in December? Feel free to share your opinions and insights in the comments section below.

Frequently Asked Questions

How much should you have of gold in your portfolio

The amount of money you need to make depends on how much capital you are looking for. Start small with $5k-10k. As you grow, you can move into an office and rent out desks. Renting out desks and other equipment is a great way to save money on rent. Rent is only paid per month.

You also need to consider what type of business you will run. My website design company charges clients $1000-2000 per month depending on the order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

Freelance work is not likely to pay a monthly salary. The project pays freelancers. This means that you may only be paid once every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Can the government steal your gold?

Because you have it, the government can't take it. It is yours because you worked hard for it. It belongs entirely to you. However, there may be some exceptions to this rule. You can lose your gold if you have been convicted for fraud against the federal governments. You can also lose precious metals if you owe taxes. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

What are the fees associated with an IRA for gold?

A monthly fee of $6 for an Individual Retirement Account is charged. This includes the account maintenance fees and any investment costs associated with your chosen investments.

You may have to pay additional fees if you want to diversify your portfolio. The type of IRA you choose will determine the fees. Some companies offer free checking accounts, but charge monthly fees to open IRA accounts.

A majority of providers also charge annual administration fees. These fees range between 0% and 1 percent. The average rate is.25% each year. These rates are usually waived if you use a broker such as TD Ameritrade.

What amount should I invest in my Roth IRA?

Roth IRAs are retirement accounts where you deposit your own money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, your principal (the original deposit amount) cannot be touched. This means that regardless of how much you contribute to an account, you cannot take out any more than you initially contributed. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule is that you cannot withdraw your earnings without paying income taxes. Also, taxes will be due on any earnings you take. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's also assume that you make $10,000 per year from your Roth IRA contributions. Federal income taxes would apply to the earnings. You would be responsible for $3500 You would have $6,500 less. Because you can only withdraw what you have initially contributed, this is all you can take out.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. Additionally, half of your earnings would be lost because they will be taxed at 50% (half the 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow for pre-tax deductions from your taxable earnings. Your traditional IRA allows you to withdraw your entire contribution plus any interest. There are no restrictions on the amount you can withdraw from a Traditional IRA.

A Roth IRA doesn't allow you to deduct your contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. There is no minimum withdrawal required, unlike a traditional IRA. You don't have to wait until you turn 70 1/2 years old before withdrawing your contribution.

How can I withdraw from a Precious metal IRA?

First, you must decide if you wish to withdraw money from your IRA account. Then make sure you have enough cash to cover any fees or penalties that may come with withdrawing funds from your retirement plan.

Consider opening a taxable brokerage instead of an IRA if it is possible to pay a penalty if your withdrawal is made before the deadline. If you choose this option, you'll also need to consider taxes owed on the amount withdrawn.

Next, calculate how much money your IRA will allow you to withdraw. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you have determined the percentage of your total savings that you would like to convert to cash, you can then decide which type of IRA to use. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

After these calculations have been completed, you will need to open a brokerage bank account. To encourage customers to open accounts, brokers often offer signup bonuses and promotions. However, a debit card is better than a card. This will save you unnecessary fees.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will take bullion bars while others require you only to purchase individual coins. Before you choose one, weigh the pros and cons.

Bullion bars, for example, require less space as you're not dealing with individual coins. However, you'll need to count every coin individually. However, individual coins can be stored to make it easy to track their value.

Some prefer to keep their money in a vault. Others prefer to store them in a safe deposit box. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options Types, Spreads, Example, and Risk Metrics

irs.gov

How To

How to Hold Physical Gold in an IRA

The easiest way to invest is to buy shares in companies that make gold. However, there are risks associated with this strategy. It isn't always possible for these companies to survive. If they survive, there's still the risk of losing money due to fluctuations in the price of gold.

Another option is to purchase physical gold. This means that you will need to open an account at a bank, bullion seller online, or purchase gold from a trusted seller. The advantages of this option include the ease of access (you don't need to deal with stock exchanges) and the ability to make purchases when prices are low. It's also easy to see how many gold you have. The receipt will show exactly what you paid. You'll also know if taxes were not paid. There's also less chance of theft than investing in stocks.

However, there are some disadvantages too. You won't get the bank's interest rates or investment money. Also, you won't be able to diversify your holdings – you're stuck with whatever you bought. Finally, the tax man might ask questions about where you've put your gold!

Visit BullionVault.com to find out more about gold buying in an IRA.

—————————————————————————————————————————————————————————————–

By: Jamie Redman

Title: Bitcoin Reigns Supreme in NFT Market With Record-Breaking $853 Million in December Sales

Sourced From: news.bitcoin.com/bitcoin-reigns-supreme-in-nft-market-with-record-breaking-853-million-in-december-sales/

Published Date: Sat, 30 Dec 2023 15:30:16 +0000

Did you miss our previous article…

https://altcoinirareview.com/the-decline-of-bonk-a-look-at-the-recent-performance-of-the-meme-coin/