Many people would believe that inflation is slowing, but the current policies make matters worse.

Below is an excerpt from Marty's Bet Issue #1261: "CPI shocks the markets." Subscribe to the newsletter here.

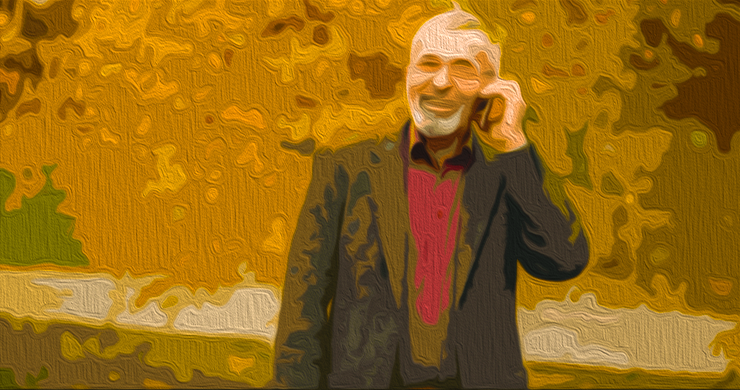

On Sept. 13, 2022, the August 2022 consumer price index print (CPI) was published. It showed 8.3% year-overyear growth. This shocked all the talk heads who believed that inflation would slow down due to all the destruction the Federal Reserve had been trying to cause. The higher-than-expected print did not go down well with markets reacting negatively to it. All major indices fell between 4-5%. Worse, 8.3% appears to be a significant underreporting of the actual price inflation consumers are experiencing right now.

It's safe for me to say that this list of essential goods can be considered essential to anyone trying to live a comfortable life. It's difficult to believe that the Fed or the Bureau of Labor Statistics would try to convince you that prices have risen 8.3% when you look at these numbers. Even worse, this year-overyear print was built from a base that was established in August 2021. Inflation began to rear its ugly head in summer 2021. August 2021 saw a 5.3% increase. 3.3% more than the historical 2% Fed target.

CPI is the Bureau of Labor Statistics.

Many inflation-splainers are out there trying to spin today’s print as a positive. They say things like "Month-over month growth is basically flat." We should begin to see the full impact of demand destruction in the coming months as the inflation rate slows down. This is a highly wishful thinking, bordering on delusion according to Uncle Marty. Two factors are not being considered: the depletion of strategic petroleum reserves (SPR), and the fact we are entering winter.

Pump inflation has been artificially tamed by the SPR being drained. The SPR will be completely drained by the end of next month. With drilling teams in the United States being pushed to the limit and the Biden administration determined to not allow any new drilling permits to go out, there will be a significant shock to the supply side of oil and gas markets. This will cause gas prices to rise. This is in addition to the fact that we are heading into fall and winter, when energy demand will increase as people travel more and turn up the heat. This is not just about energy prices.

The world has learned that energy prices, particularly natural gas prices are crucial inputs to food supply chains. It shouldn't surprise anyone that prices rose significantly earlier in the planting season this year, and that lagging inflation will also hit the markets later on in 2022. The U.S. seems to be keen on intensifying relations with China due to their invasion of Taiwan's sovereignty.

Consumers should be able to enjoy more sanctions in 2022. The U.S. could increase inflation by imposing sanctions on China. This could make it more difficult or prohibitive for Americans to access China's manufacturing facilities. It may also create a retaliatory reaction by China, increasing military activity in Taiwan and making it more difficult for international markets to access vital computer chips made by TSMC.

Many people believe inflation is slowing down. However, I see things that will only make our problems worse. We may be facing the inflation hurricane, contrary to popular belief.

—————————————————————————————————————————————————————————————–

By: Marty Bent

Title: Consumers Are In The Eye Of The Inflation Hurricane

Sourced From: bitcoinmagazine.com/markets/consumers-are-in-the-inflation-hurricane

Published Date: Thu, 15 Sep 2022 07:00:00 GMT

Did you miss our previous article…

https://altcoinirareview.com/foreigners-to-be-given-anonymous-entry-points-to-digital-ruble-russian-official-suggests/