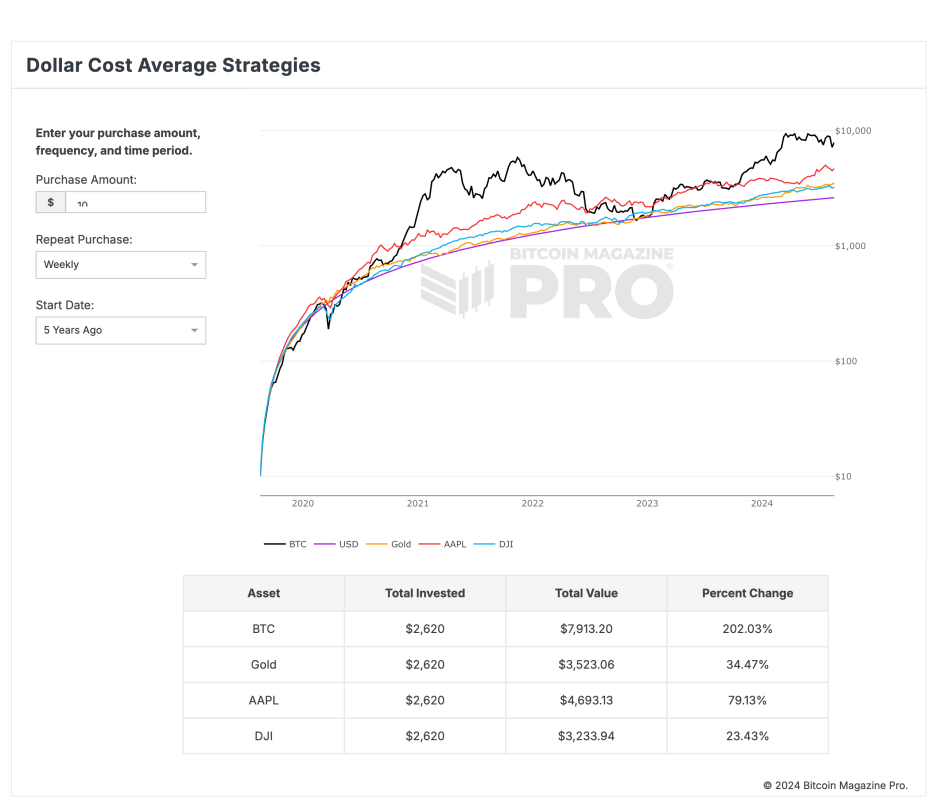

A recent analysis conducted by Bitcoin Magazine Pro highlights the effectiveness of dollar-cost averaging (DCA) when investing in Bitcoin compared to traditional assets such as gold, Apple stock, and the Dow Jones Industrial Average (DJI). The data demonstrates that consistently investing $10 per week in Bitcoin over the past five years would have turned an initial investment of $2,620 into $7,913.20, resulting in an impressive 202.03% return.

Comparing Returns

On the other hand, investing the same amount weekly in gold produced a return of 34.47%, growing the initial $2,620 to $3,523.06. Apple stock also performed well, generating a return of 79.13% and turning the $2,620 investment into $4,693.13. In contrast, the Dow Jones showed the lowest return of 23.43%, increasing the investment to $3,233.94.

Bitcoin as a Superior Asset

This data underscores Bitcoin's potential as one of the most lucrative assets for investors to include in their long-term investment strategies. The concept of dollar-cost averaging, which involves investing a fixed amount regularly regardless of price fluctuations, has proven to be highly effective with Bitcoin, enabling investors to accumulate wealth steadily over time.

Benefits of Dollar Cost Averaging with Bitcoin

By saving $10 per week through Dollar Cost Averaging (DCA) in Bitcoin, individuals can embark on an affordable and accessible investment journey. This strategy is particularly attractive for beginners who may be hesitant to invest large sums upfront or are still navigating the volatile nature of the Bitcoin market. Through consistent, fixed investments, investors can steadily grow their Bitcoin holdings, mitigating the impact of market volatility and fostering a long-term investment mindset. This approach facilitates consistent growth over time, alleviating the pressure of timing the market perfectly.

Utilizing Dollar Cost Average Strategies Tool

The Dollar Cost Average Strategies tool offered by Bitcoin Magazine Pro empowers users to explore various investment approaches, optimizing their Bitcoin investments across different time frames. By comparing Bitcoin's performance with other assets like the US dollar, gold, Apple stock, and the Dow Jones, the tool highlights Bitcoin's potential as a superior store of value within a diversified investment portfolio.

For in-depth insights, detailed information, and access to Bitcoin Magazine Pro's data and analytics, you can visit the official website.

Frequently Asked Questions

What is a gold IRA account?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

You can purchase gold bullion coins in physical form at any moment. To start investing in gold, it doesn't matter if you are retired.

Owning gold as an IRA has the advantage of allowing you to keep it forever. When you die, your gold assets won't be subjected to taxes.

Your heirs will inherit your gold, and not pay capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

First, an individual retirement account will be set up to allow you to open a golden IRA. Once you've done so, you'll be given an IRA custodian. This company acts like a middleman between the IRS and you.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual reports.

Once you've set up your gold IRA, it's possible to buy gold bullion. Minimum deposit is $1,000 The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

When you withdraw your gold from your IRA, you'll pay taxes on it. If you take out the whole amount, you'll be subject to income taxes as well as a 10 percent penalty.

Even if your contribution is small, you might not have to pay any taxes. There are exceptions. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

You shouldn't take out more then 50% of your total IRA assets annually. You'll be facing severe financial consequences if you do.

Should You Invest in gold for Retirement?

This will depend on how much money and whether you were able to invest in gold at the time that you started saving. If you are unsure which option to choose, consider investing in both options.

You can earn potential returns on your investment of gold. This makes it a worthwhile choice for retirees.

Gold is more volatile than most other investments. Therefore, its value is subject to change over time.

This doesn't mean that you should not invest in gold. It is important to consider the fluctuations when planning your portfolio.

Another benefit to gold is its tangible value. Gold is more convenient than bonds or stocks because it can be stored easily. It's also portable.

As long as you keep your gold in a secure location, you can always access it. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. As gold prices rise in tandem with other commodities it can be a good hedge against rising cost.

You'll also benefit from having a portion of your savings invested in something that isn't going down in value. Gold tends to rise when the stock markets fall.

Investing in gold has another advantage: you can sell it anytime you want. You can easily liquidate your investment, just as with stocks. It doesn't matter if you are retiring.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Also, don't buy too much at once. Start small, buying only a few ounces. Then add more as needed.

It's not about getting rich fast. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

Although gold might not be the right investment for everyone it could make a great addition in any retirement plan.

Should You Buy or Sell Gold?

Gold was a safe investment option for those who were in financial turmoil. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

The gold price has been in an upward trend for the past few years, but it remains relatively low compared with other commodities like silver or oil.

Some experts believe that this could change very soon. They believe gold prices could increase dramatically if there is another global financial crises.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

These are some important things to remember if your goal is to invest in gold.

- First, consider whether or not you need the money you're saving for retirement. It is possible to save for retirement while still investing your gold savings. However, when you retire at age 65, gold can provide additional protection.

- Second, ensure you fully understand the risks involved in buying gold. Each one offers different levels security and flexibility.

- Keep in mind that gold may not be as secure as a bank deposit. Your gold coins may be lost and you might never get them back.

You should do your research before buying gold. You should also ensure that you do everything you can to protect your gold.

Can the government take your gold

You own your gold and therefore the government cannot seize it. It's yours, and you earned it by working hard. It belongs exclusively to you. However, there may be some exceptions to this rule. Your gold could be taken away if your crime was fraud against federal government. Also, if you owe taxes to the IRS, you can lose your precious metals. You can keep your gold even if your taxes are not paid.

What are the pros and cons of a gold IRA?

An Individual Retirement Account (IRA), unlike regular savings accounts, doesn't require you to pay tax on interest earned. This makes an IRA a great choice for people who are looking to save money but don’t want to pay any tax on the interest earned. However, there are disadvantages to this type investment.

For example, if you withdraw too much from your IRA once, you could lose all your accumulated funds. The IRS may prevent you from taking out your IRA funds until you reach 59 1/2. You will likely have to pay a penalty fee if you withdraw funds from an IRA.

A disadvantage to managing your IRA is the fact that fees must be paid. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

Insurance will be required if you would like to keep your cash out of banks. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you choose to have a gold IRA you will need to establish how much gold to use. Some providers restrict the amount you can own in gold. Some providers allow you to choose your weight.

You'll also need to decide whether to buy physical gold or futures contracts. Physical gold is more costly than gold futures. Futures contracts offer flexibility for buying gold. They enable you to establish a contract with an expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy doesn't include theft protection or loss due to fire, flood, or earthquake. It does include coverage for damage due to natural disasters. If you live near a high-risk region, you might want to consider additional coverage.

You should also consider the cost of storage for your gold. Insurance doesn't cover storage costs. Banks charge between $25 and $40 per month for safekeeping.

To open a IRA in gold, you will need to first speak with a qualified custodian. A custodian keeps track of your investments and ensures that you comply with federal regulations. Custodians don't have the right to sell assets. Instead, they must keep your assets for as long you request.

After you've determined which type of IRA is best for you, fill out the paperwork indicating your goals. You must include information about what investments you would like to make (e.g. stocks, bonds and mutual funds). Also, you should specify how much each month you plan to invest.

After filling in the forms, please send them to the provider. Once the company has received your application, they will review it and send you a confirmation email.

When opening a gold IRA, you should consider using a financial planner. Financial planners are experts in investing and will help you decide which type of IRA works best for your situation. They can also help you lower your expenses by finding cheaper alternatives to purchasing insurance.

What does gold do as an investment?

The price of gold fluctuates based on supply and demand. It is also affected by interest rates.

Gold prices are volatile due to their limited supply. Physical gold is not always in stock.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

finance.yahoo.com

bbb.org

irs.gov

investopedia.com

How To

The best way online to buy gold or silver

Before you can buy gold, it is important to understand its workings. Gold is a precious metal similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is very difficult to use and most people prefer to purchase jewelry made of it over actual bars of Gold.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. Legal tender coins are those that are intended for circulation in a country. They typically have denominations of $1, $5 or $10.

Bullion coins are minted for investment purposes only, and their values increase over time due to inflation.

They are not exchangeable in any currency exchange system. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Each dollar spent by the buyer is worth 1 gram.

Next, you need to find out where to buy gold. You have a few options to choose from if you are looking to buy gold directly through a dealer. First, your local currency shop is a good place to start. You might also consider going through a reputable online seller like eBay. You can also purchase gold through private online sellers.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers will charge you a 10% to 15% commission for every transaction. You would receive less money from a private buyer than you would from a coin store or eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

You can also invest in gold physical. Physical gold is much easier to store than paper certificates, but you still have to worry about storing it safely. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank can give you a loan up to the amount you intend to invest in Gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks typically charge higher interest rates than pawn shops.

Another way to purchase gold is to ask another person to do it. Selling gold is simple too. Set up a simple account with GoldMoney.com and you will start receiving payments instantly.

—————————————————————————————————————————————————————————————–

By: Nik Hoffman

Title: $10 Weekly Bitcoin DCA Strategy Outperforms Traditional Assets by 202% in 5 Years

Sourced From: bitcoinmagazine.com/markets/10-weekly-bitcoin-dca-yields-202-return-outshines-traditional-assets-over-5-years

Published Date: Wed, 14 Aug 2024 20:00:00 GMT